2022-2023 China Pet Industry Development and Consumer Survey Research Report

The Spring Festival is approaching, and many "poop shovelers" are preparing to go home to celebrate the New Year, but they are faced with a problem: who will feed their pets if they are gone? On the WeChat mini program, bookings for door-to-door feeding services during the Spring Festival are very popular. As pets penetrate into people's lives, the public is paying more and more attention to the emotional appeal of pets. Many brand merchants use pets as a gimmick to attract consumers.

With the rise of the trend of exquisite pet care, pet owners have become accustomed to buying New Year goods for their pets, so that their pets can also feel the joy of the New Year. According to sales data during JD.com’s Pet New Year Festival in 2023, sales of pet New Year’s Eve dinners increased by 64% year-on-year, and sales of pet New Year’s clothing increased by 55% year-on-year. Giving pets a new year has become a new trend in pet raising.

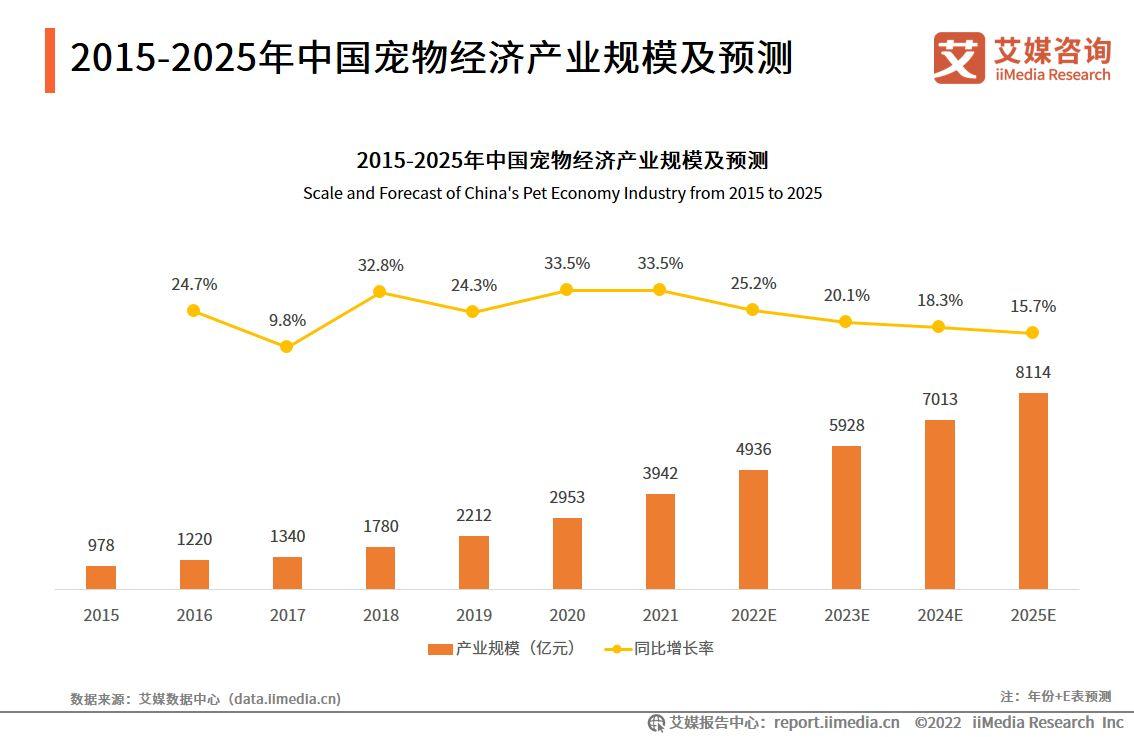

According to the "iiMedia Consulting | 2022-2023 China Pet Industry Development and Consumer Survey Research Report" released by iiMedia Research, driven by the demand side, supply side and capital of the pet industry, the scale of China's pet economic industry has grown rapidly. , the market size is expected to reach 811.4 billion yuan in 2025.

Core point of view

China’s pet market will reach 493.6 billion yuan in 2022 and 811.4 billion yuan in 2025

The scale of China's pet economic industry will reach 493.6 billion yuan in 2022, a year-on-year increase of 25.2%. The scale of the pet food industry is expected to reach 267 billion yuan in 2022, and the Chinese pet products market will reach 36.9 billion yuan in 2022. Driven by the demand side, supply side and capital of the pet industry, the scale of China's pet economic industry is growing rapidly, and the market size is expected to reach 811.4 billion yuan in 2025.

Eighty percent of consumers spend more than 500 yuan on average annually, and their monthly purchases are mostly concentrated in 1-2 or 3-4 times.

Data from iiMedia Research shows that pet owners mostly consume pets 1-2 or 3-4 times a month; pet consumption is mainly reflected in pet food, supplies and medical care. 88.3% of Chinese pet consumers spend more than 500 yuan per year on average; groups with higher personal disposable income also spend more on pets.

The pet industry is developing towards diversification and refinement

With the increase in consumer demand, pet products and food continue to develop in a diversified direction. At this stage, pet food is no longer limited to a simple satiety function. It also has a repairing and promoting effect on pets' nervous system, immune system, bones and joints, etc. Functional pet food is becoming more and more refined and diversified.

The following is an excerpt from the report:

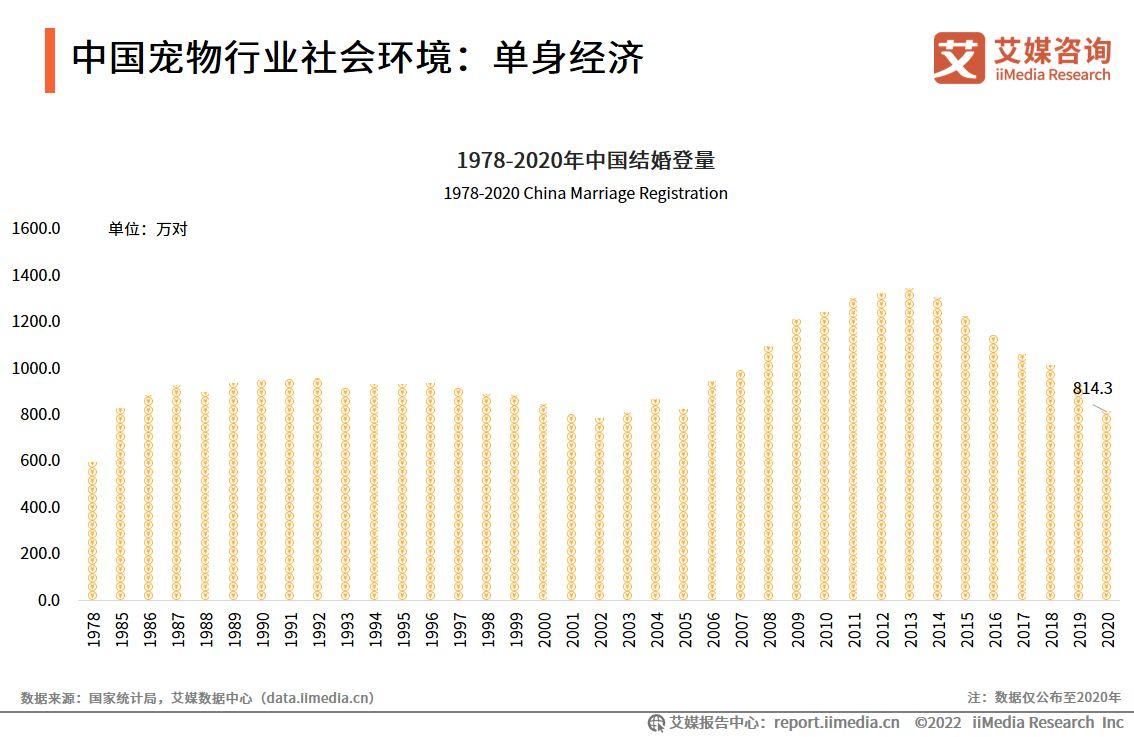

Social environment of China’s pet industry: single economy

Data shows that since 2013, the number of marriage registrations in China has begun to decline year by year. The number of marriage registrations nationwide in 2020 was 8.143 million, a decrease of 1.13 million compared with 2019. iiMedia Consulting analysts believe that the fast-paced work and life indirectly affects the single ratio of urban men and women. Relative to married people, single people have stronger spending power. Pets have the attribute of companionship, and the single economy is an important factor promoting the development of the pet industry.

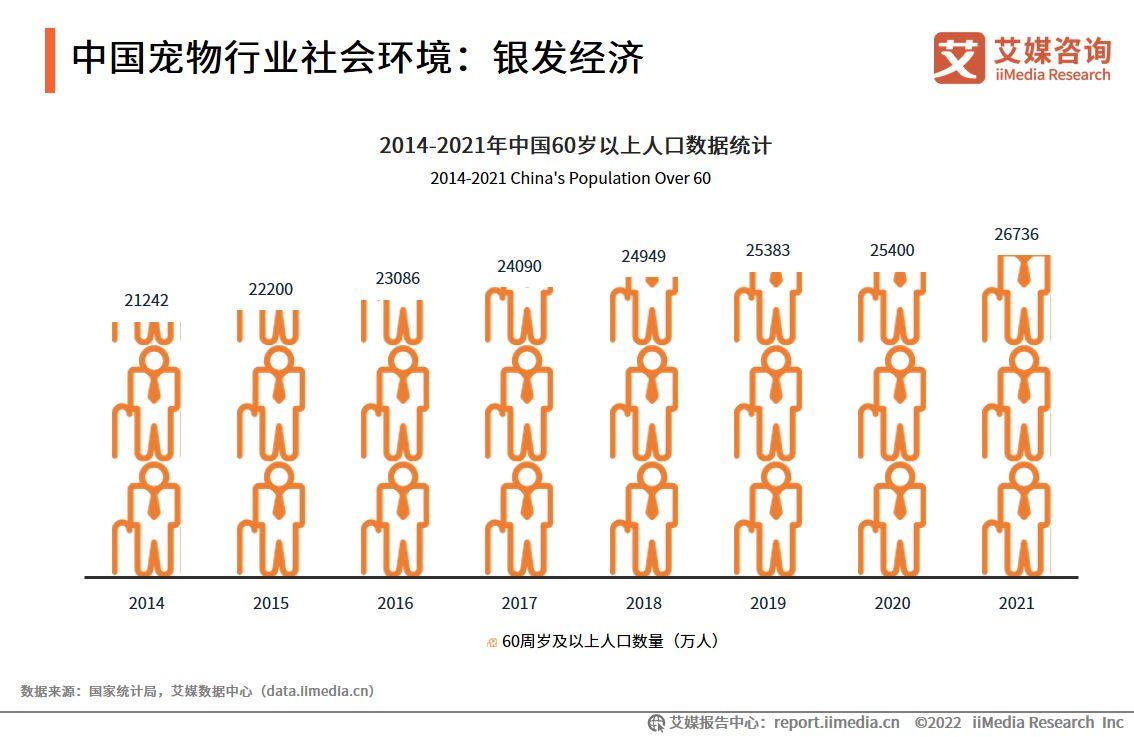

Social environment of China’s pet industry: Silver economy

Since 2014, the country’s population over 60 years old has increased year by year, reaching nearly 270 million in 2021. iiMedia Consulting analysts believe that many empty-nest elderly people live lonely lives in their later years, and keeping pets can improve their happiness in life.

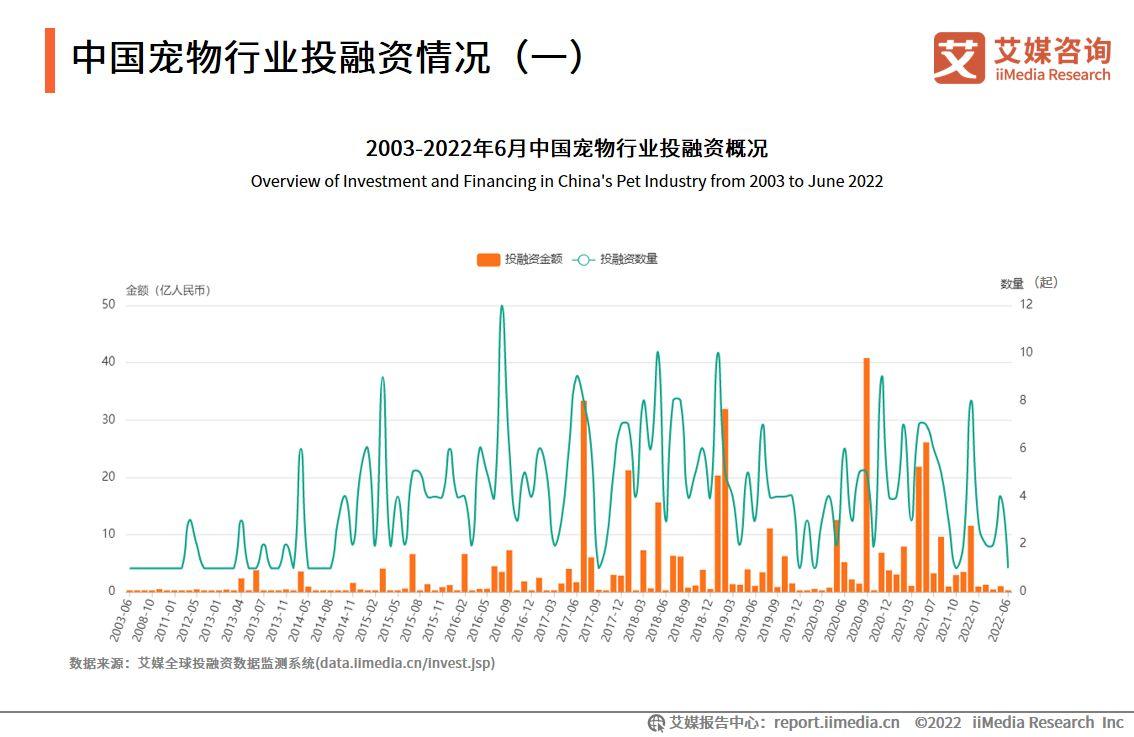

Investment and Financing Situation of China’s Pet Industry (1)

Scale and forecast of China’s pet economy industry from 2015 to 2025

Driven by the demand side, supply side and capital of the pet industry, the scale of China's pet economic industry has grown rapidly. The scale of China's pet economy industry will reach 493.6 billion yuan in 2022, a year-on-year increase of 25.2%, and the market size is expected to reach 811.4 billion yuan in 2025.

Brand map of China’s pet industry

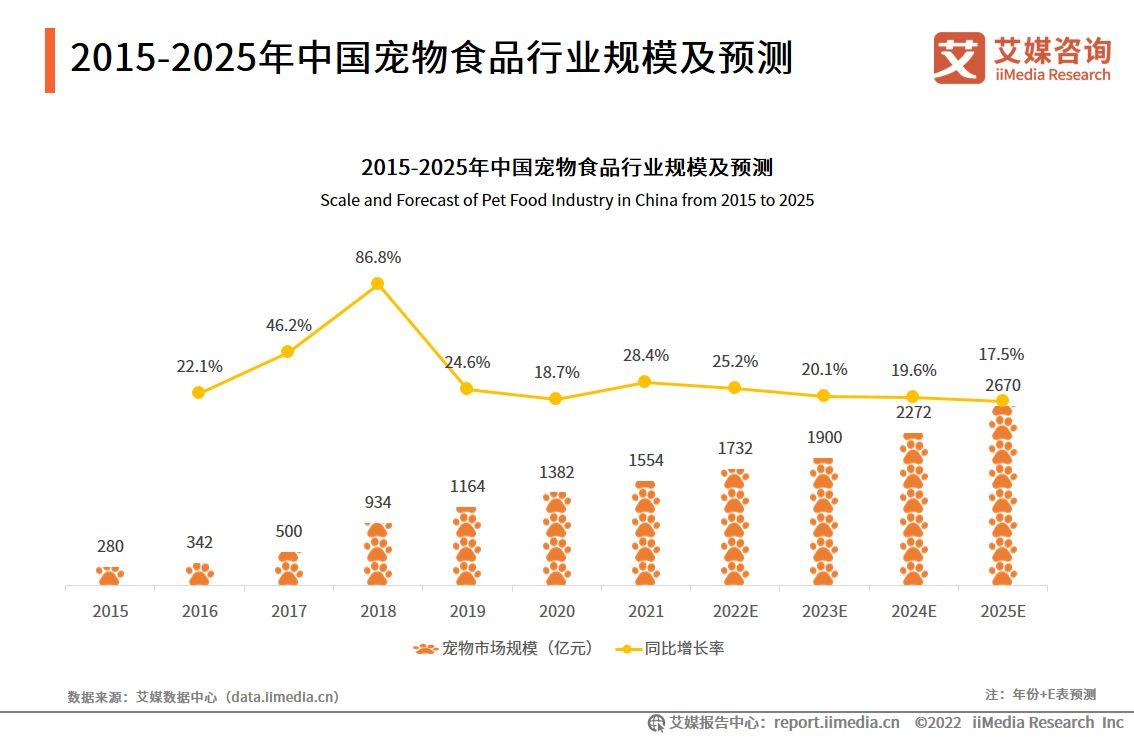

Scale and forecast of China’s pet food industry from 2015 to 2025

Data shows that the scale of China's pet food industry is expected to reach 173.2 billion yuan in 2022. With the development of society and the continuous promotion and popularization of the concept of pet keeping, the high-growth pet industry has become a blue ocean in the market. Pet food has characteristics such as large consumption, which has attracted many start-ups to enter this track. This has gradually increased the market share of local brands, while the market share of overseas brands has gradually declined. It is expected that the size of China's pet food market will reach 2670 in 2025. billion.

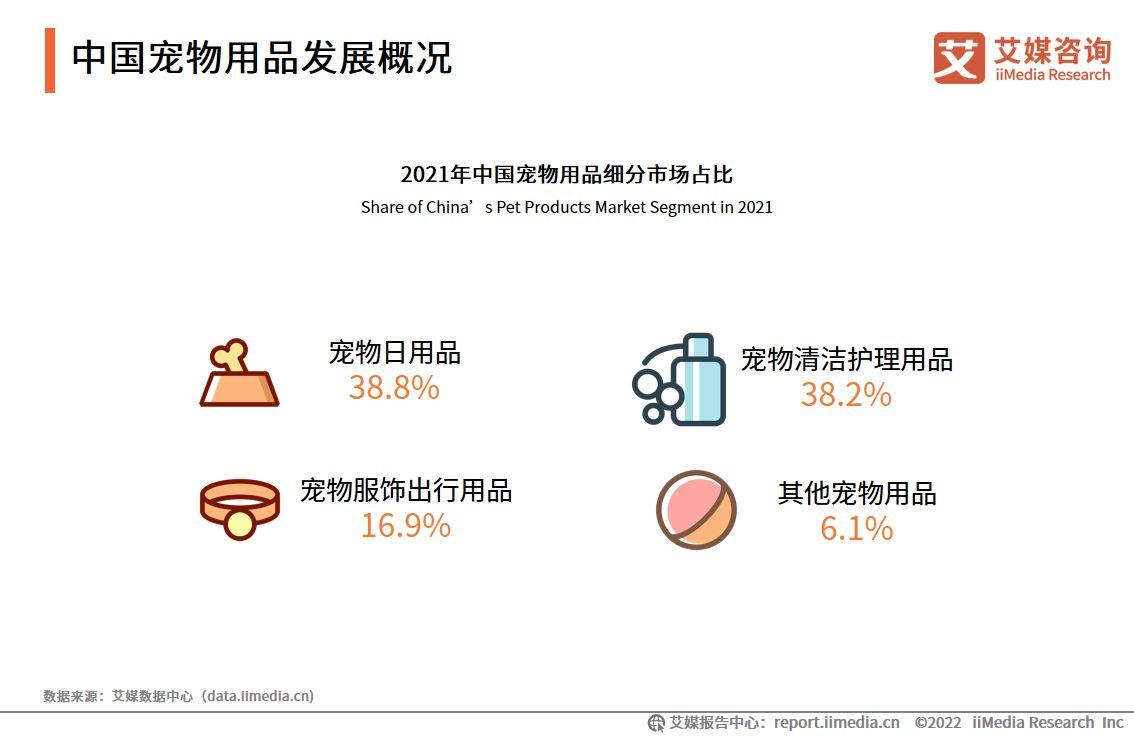

Overview of the development of pet products in China

Chinese consumers’ demand for pet products continues to increase, which has promoted the growth of pet consumption and promoted the continuous increase of industry segments. Survey data shows that among China’s pet products market segments, pet daily necessities account for 38.8%, pet cleaning and care products account for 38.2%, and pet apparel and travel products account for 16.9%. iiMedia Consulting analysts believe that in addition to meeting the basic physiological needs of pets, pet owners at this stage also pay special attention to pet cleaning, care, entertainment and grooming. These new categories are becoming new growth points for pet products.

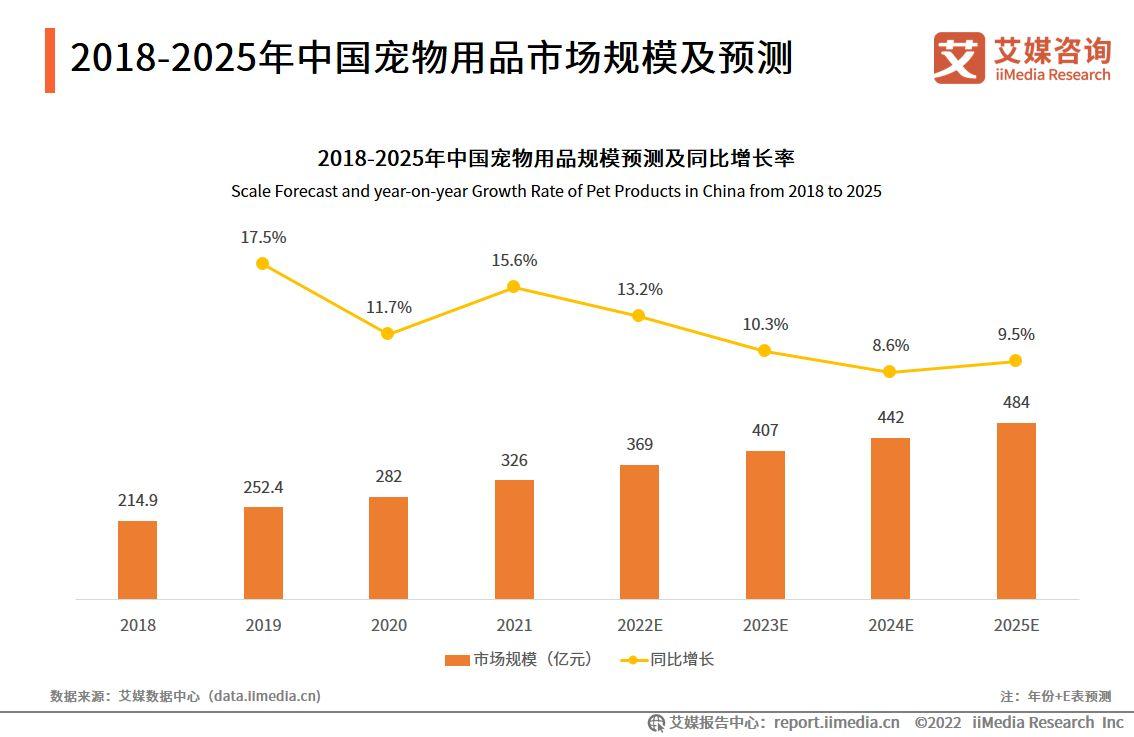

China’s pet products market size and forecast from 2018 to 2025

Data shows that China's pet products market continues to expand, and it is expected that China's pet products market will reach 36.9 billion yuan in 2022, a year-on-year increase of 13.2%. iiMedia Consulting analysts believe that driven by the pet economy, various pet product segments are constantly emerging. As the R&D and production capabilities of pet companies continue to increase, various products with pet characteristics will become an increment in driving the development of the pet products market. The size of the pet products market will reach 48.4 billion yuan in 2025.

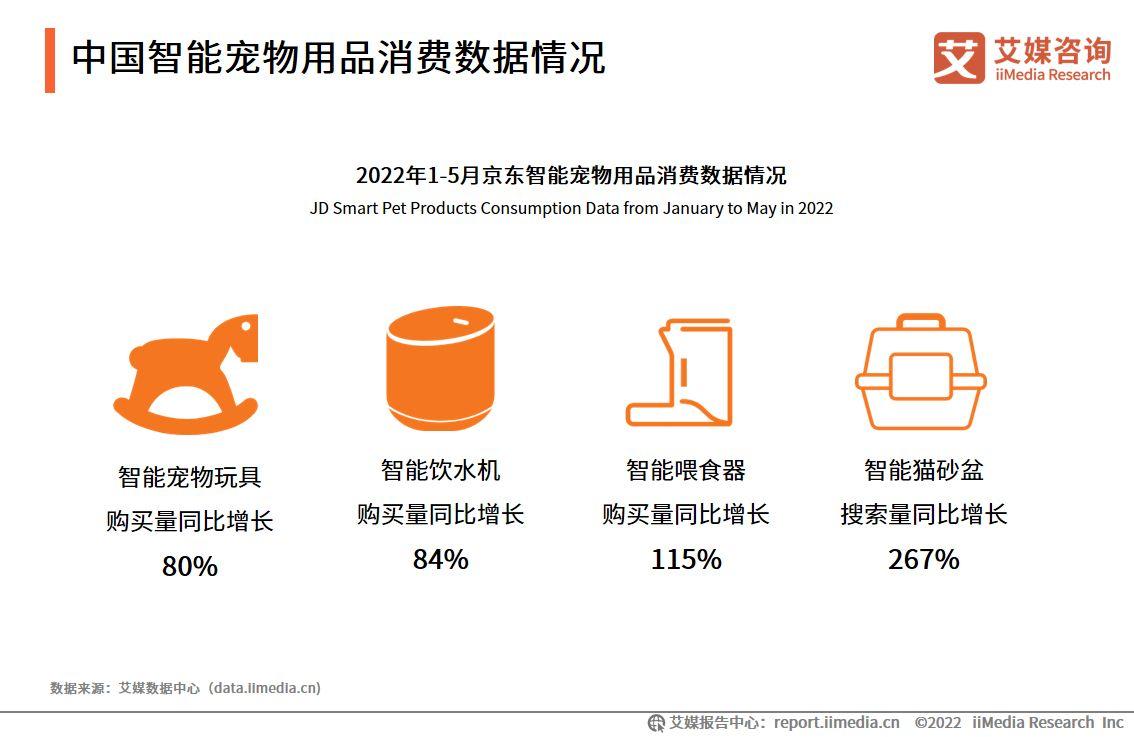

China’s smart pet product consumption data

Data shows that from January to May 2022, the purchase volume of smart pet toys on JD.com increased by 80% year-on-year, the purchase volume of smart water dispensers increased by 84% year-on-year, the purchase volume of smart feeders increased by 115% year-on-year, and the search volume of smart cat litter boxes increased by 267% year-on-year. . iiMedia Consulting analysts believe that digitalization and intelligent upgrading have become the future development trend of China's pet products industry. Xiaomi, Midea, Haier and other technology giants have entered the pet products industry across borders, which has also brought new growth points to the smart products category. .

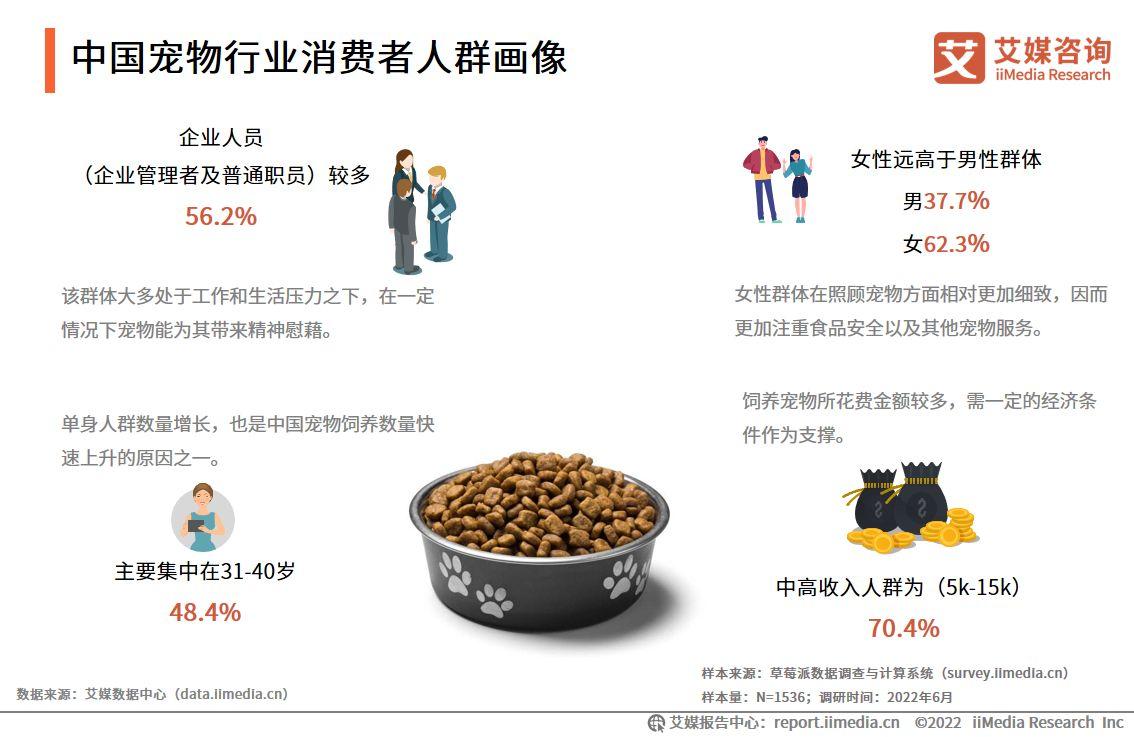

Portraits of consumers in China’s pet industry

Survey on consumption frequency and amount of pet food consumers in China

Survey data shows that Chinese pet owners consume pet food 1-2 times or 3-4 times a month. More than 80% of consumers spend more than 500 yuan on average annually. iiMedia Research analysts further analyzed and found that groups with higher personal disposable income spend more on pet food. This means that under the current social macro-background where national consumption maintains steady growth, pet food consumption will also maintain steady growth, which brings new momentum to pet food companies.

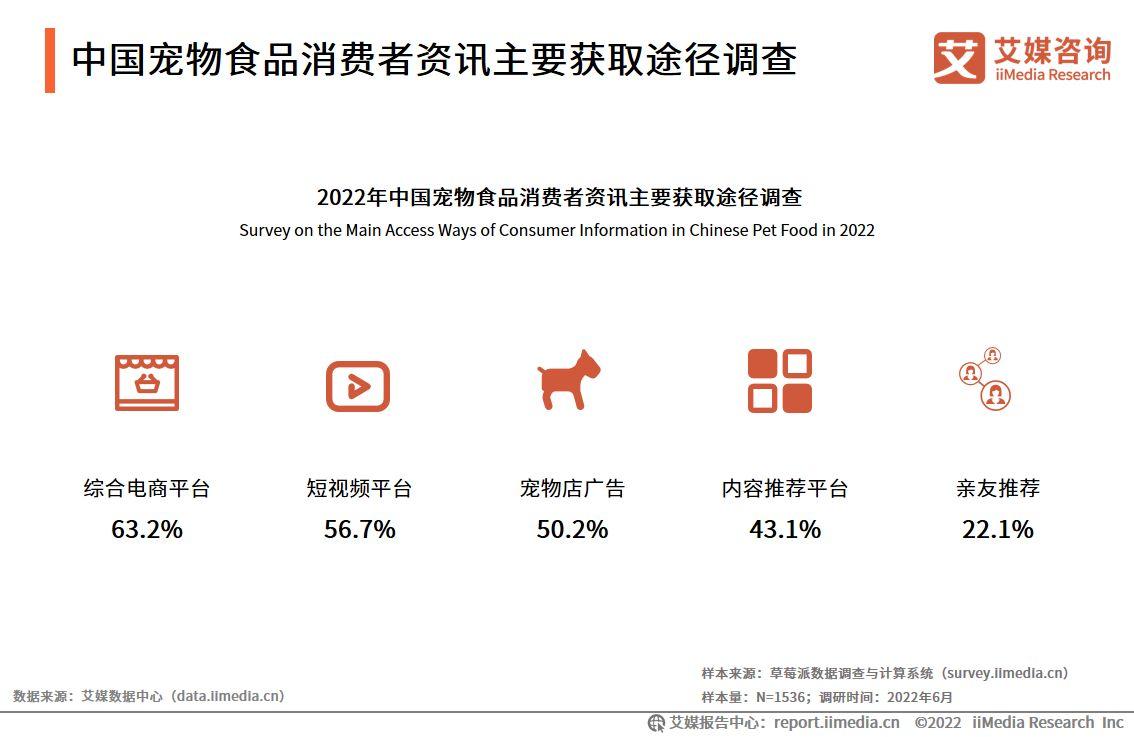

Survey on the main channels for obtaining information on pet food consumers in China

Survey data shows that comprehensive e-commerce platforms are the main way for Chinese pet food consumers to obtain information. iiMedia Consulting analysts believe that the e-commerce platform's presentation of pet food production dates and food formulas is more intuitive than other platforms, and the comprehensive e-commerce platform's live broadcast, comments and other functions allow consumers to understand product details more clearly. It is easier for consumers to have a desire to buy and conclude a transaction.

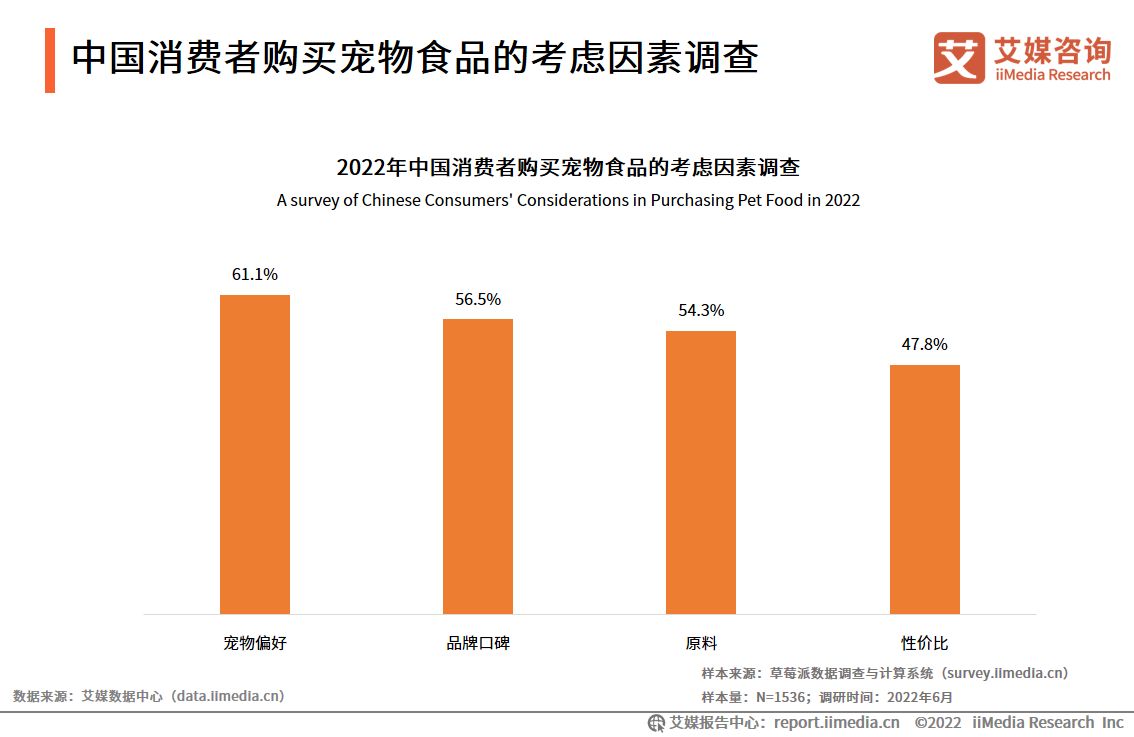

Survey on factors that Chinese consumers consider when purchasing pet food

Survey data shows that when consumers purchase pet food, more than 60% of consumers are most concerned about pet preference, followed by brand reputation and product ingredients. iiMedia Consulting analysts believe that as the status of pets in people's minds continues to increase, the quality requirements for pet food are also getting higher and higher. Good brand reputation will help increase consumer stickiness and increase consumer repurchase rates.

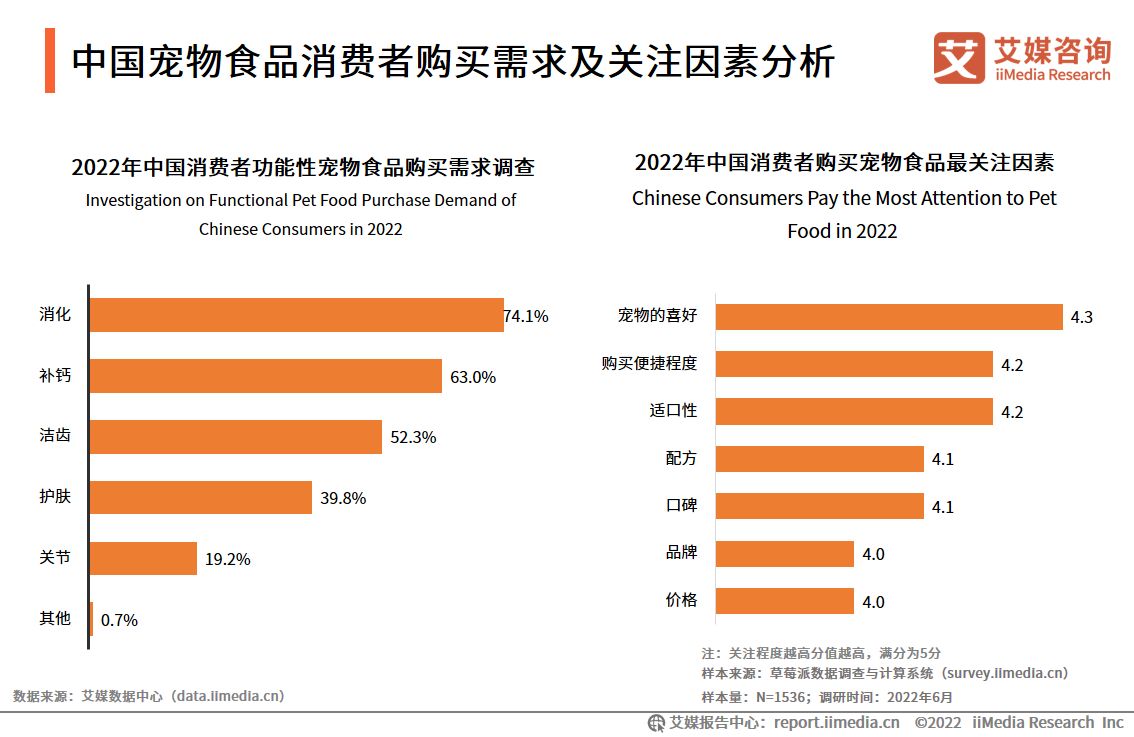

Analysis of purchasing needs and factors of concern among Chinese pet food consumers

Survey data shows that Chinese consumers have diversified demands for purchasing pet food. Among the factors that concern pet food, consumers pay the most attention to pet preferences. There are currently many functional foods in the pet food market, and survey results show that when choosing pet food, more pet owners will consider whether these functional foods match the needs of the pets they raise, and consumption rationality is generally higher.

Survey on purchase amount of Chinese pet product consumers

Survey data shows that the annual purchase amount of Chinese pet product consumers is mainly concentrated in the range of 501-1,500 yuan, of which 31.5% are consumers who purchase 501-1,000 yuan, and those who purchase 1,000-1,500 yuan account for 31.5% of the total. 32.2%, the proportion of consumers with purchase amount of 1501-2000 yuan accounted for 14.3%, the proportion of consumers with purchase amount of less than 500 yuan and more than 2000 yuan accounted for 11.8% and 10.2% respectively. iiMedia Consulting analysts believe that with the improvement of income and living standards, consumers’ investment in pet products is also increasing.

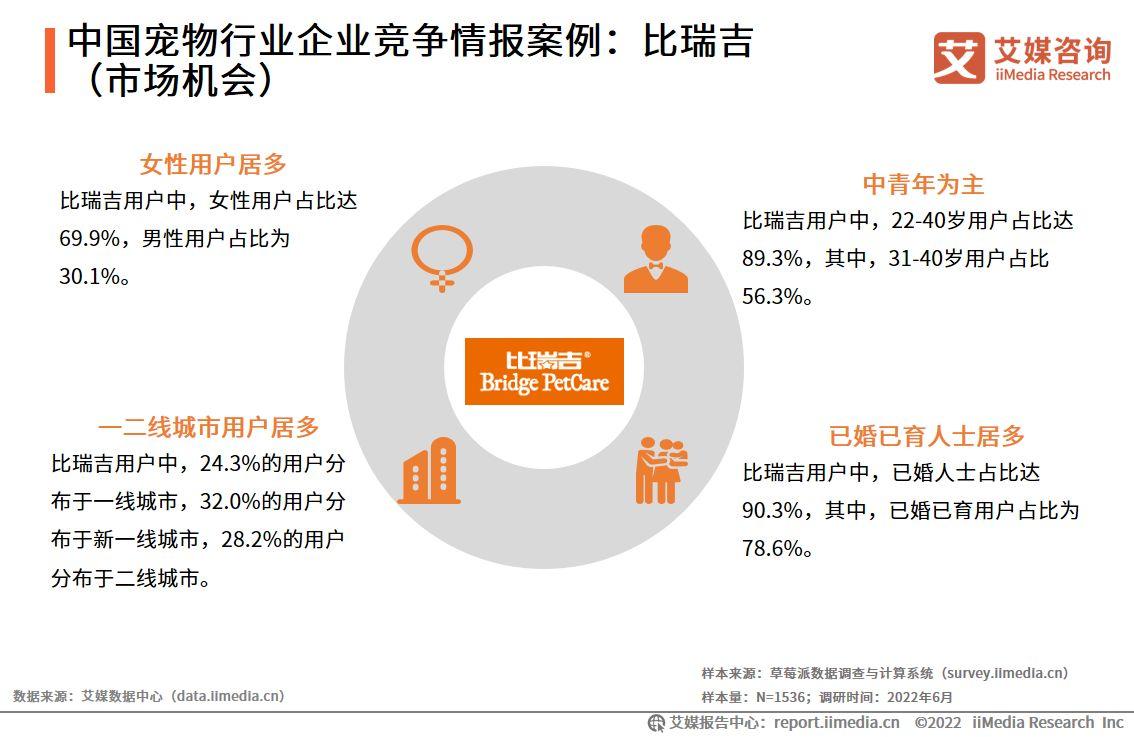

Competitive Intelligence Case of Enterprises in China’s Pet Industry: Birugi (Market Opportunities)

Competitive Intelligence Case of Chinese Pet Industry Enterprises: Biruji (Business Situation and Public Opinion)

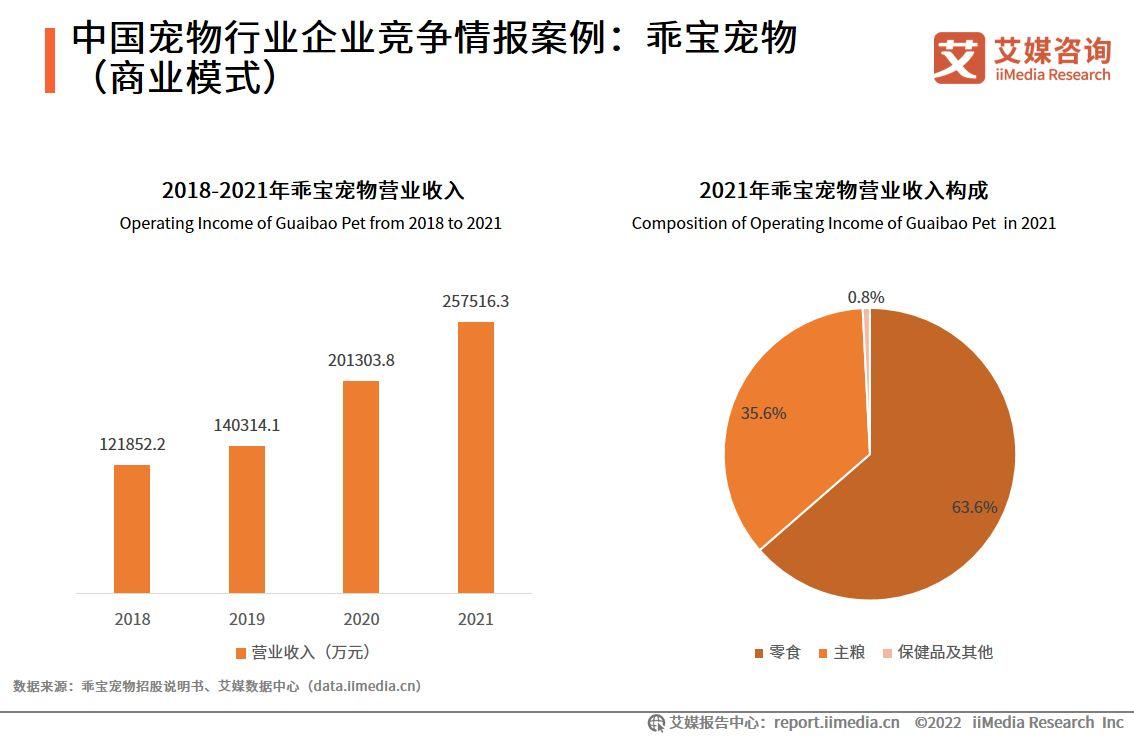

Competitive Intelligence Case of Enterprises in China’s Pet Industry: Guabao Pets (Business Model)

Data shows that from 2018 to 2021, Guabao Pet's operating income has increased year by year. The main source of income is pet snacks and staple food. Overseas markets are an important source of Guabao Pet's operating income, accounting for 47.8% in 2021. The United States is the company's main export country. . iiMedia Consulting analysts believe that Guobao Pets can reduce the impact of US tariffs on sales in overseas markets and improve the competitiveness of its own brand in the domestic market by increasing the construction of domestic independent brands.

Competitive Intelligence Case of Chinese Pet Industry Enterprises: Guabao Pets (Business Situation and Public Opinion)

Analysis of development trends of China’s pet industry in 2022-2023 (1)

China’s pet economy is in the development stage, and the pet food industry has received relatively high capital attention.

Compared with the pet economy in developed countries, China's current pet market is in its infancy. Pet-related industries and peripherals have become an independent industry, and market segmentation is becoming more and more refined. In the past two years, China's pet food industry has received a lot of financing, mainly in early rounds. As an important part of the pet economy, pet food has always been a segment that capital and entrepreneurs are optimistic about.

Diversification and refinement will become a new trend in pet food consumption

Dry food has a stable market position and is an important part of the pet food industry. Functional pet food benefits from pet owners’ increased awareness of scientific feeding concepts and has great development potential. As a supplement to pet food, pet nutrition products cater to the needs of pet consumption upgrades. At this stage, pet food is no longer limited to a simple satiety function. It also has a protective and repair effect on pets' nervous system, immune system, bones and joints, etc. Functional pet food is becoming more and more refined and diversified.

Analysis of development trends of China’s pet industry in 2022-2023 (2)

The coordinated development of online and offline channels has become the optimal sales model for pet food and supplies.

According to survey data, 72.1% of consumers purchase pet products from offline pet stores, and 64.4% from e-commerce channels. The pet industry shows obvious characteristics of low brand concentration and high e-commerce penetration rate, and online channels have become the most important sales channel in the pet industry.

Affected by the epidemic, pet owners are more willing to stock up on pet food and supplies during the promotion period. Judging from the long-term development trend of the pet industry, omni-channel operation is the foundation for the development of the pet industry. For brands, offline channels are the basis for pet companies to create brand effects. By establishing a good brand image, revenue scale can be amplified through online channels.

Analysis of development trends of China’s pet industry in 2022-2023 (3)

Nutritional and health products may become a new consumer trend in pet food

As the concept of scientific pet raising is gradually accepted by people, pet owners pay more attention to the healthy growth of their pets. The market demand for pet snacks has increased. The increase in per capita disposable income has also increased consumers' willingness to pay for pets. Nutrition Balanced and well-known brands will become the new consumption trend of pet food. More and more pet owners are paying attention to the nutritional ratio and brand awareness of pet food.

The rise of domestic brands, focusing on the domestic market, and building independent brands

Most of the existing domestic pet food and supplies companies focus on foreign markets. With the rapid development of domestic e-commerce channels and the upgrading of residents' consumption, the consumer demand for pet food and supplies has increased. Many domestic brands have shifted from the foundry model to the development of domestic independent brands, and accelerated omni-channel layout to seize domestic market share.

Analysis of development trends of China’s pet industry in 2022-2023 (4)

With the two-way development of the supply side and demand side of pet food supplies, capital has begun to pay attention to the pet field. Since 2015, capital has stepped up its efforts to enter the pet industry, and its development areas include upstream live animal trading, midstream food supplies, and downstream e-commerce Internet celebrities.

The entry of capital has made the competition among pet companies increasingly fierce. In the process of industry development, the domestic market is facing a three-party competition situation among traditional pet food products, well-known foreign brands and new brands. But in the long run, the pet industry will continue to be reshuffled. If we can work hard on quality, research and development, channels and marketing, and establish brands through long-term operations, domestic brands such as Chaoyun Group and China Pet will be able to successfully "break through".