Analysis on Supply and Demand Status and Market Price of Chinese Fish Meal Industry in 2021

Overview of the development of fishmeal industry in China

Fish meal is a kind of protein feed made from one or more kinds of fish after degreasing, dehydration and crushing. The fishmeal producing countries in the world mainly include Peru, Chile, Japan, Denmark, the United States, etc. The export volume between Peru and Chile accounts for more than 50% of the total trade volume.

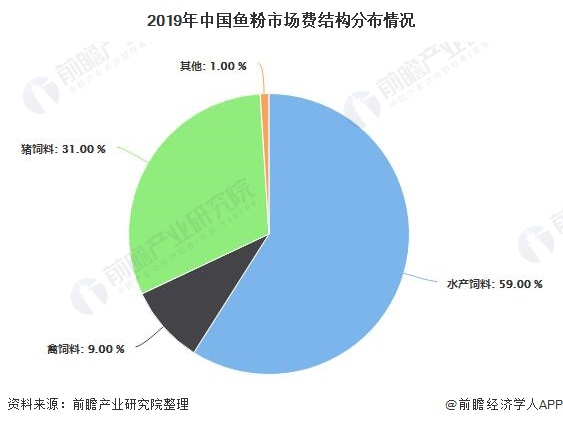

The output of fish meal in China is not high. The main production places are Shandong Province and Zhejiang Province, followed by Hebei, Tianjin, Fujian, Guangxi and other provinces and cities. Fish meal is mainly used for feed consumption, accounting for up to 90%. The main downstream demand market for fish meal is aquatic feed, followed by pig feed, accounting for 59% and 31% respectively.

1. Fluctuation of fishmeal production in China and recent reduction

From the perspective of China's fishmeal output, it generally presents periodic changes. From 2008 to 2011, China's fishmeal output increased year by year, and in 2011, the fishmeal output reached 305000 tons; From 2012 to 2015, the output of fish meal increased year by year, reaching 391000 tons in 2015; In 2016-2019, the output of fish meal increased, and in 2019, the output of fish meal in China reached 475,000 tons.

However, in 2020, due to the COVID-19 and unpredictable climate conditions, the fishmeal and fish oil markets will be negatively affected to some extent. China's fishmeal output will only be 370000 tons, down 22.1% year on year.

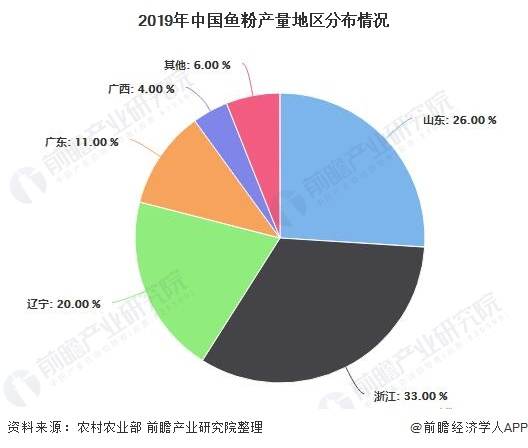

Judging from the regional distribution of fishmeal production in China, Zhejiang fishmeal producing areas account for about 33%; Shandong, accounting for 26%; Liaoning, about 20%; Guangdong, Guangxi and other regions account for 11% and 4% respectively.

2. The import of fish meal for feed fluctuates greatly, showing a downward trend as a whole

From 2008 to 2019, the import volume of fish meal for feed fluctuated greatly on the whole. In 2013, the import volume of fish meal for feed was at a low value of 980000 tons in the past decade; 2017 was the high value of China's fishmeal imports in the past decade, 1.57 million tons; In 2018, China's import of fish meal for feed was 1.45 million tons. In 2019, China's import of fish meal for feed was 1.42 million tons. According to the annual report on Chinese oilseeds issued by the U.S. Department of Agriculture's Agricultural Counsellor in Beijing, China's import of fish meal in 2020 is expected to be 1.4 million tons. Since 2017, the quantity of imported fish meal has shown a downward trend.

3. China's demand remains high

From 2004 to 2020, the total consumption of fish meal in China showed an upward trend; In 2019, the consumption of fish meal in China was 1.946 million tons, reaching a stage high. In 2020, the consumption of fishmeal in China will decline to 1.736 million tons, down 10.8% year on year, but still at a high level. The demand for fishmeal will continue to be higher than the domestic output and import, and the supply and demand will be tight and balanced.

From the perspective of consumption structure of fish meal, the main downstream demand market for fish meal is aquatic feed, followed by pig feed, accounting for 59% and 31% respectively.

The growth rate of consumption in 2008 was 26.78%.

4. China's fishmeal production and sales rate remains high, and domestic supply and demand are tight balanced

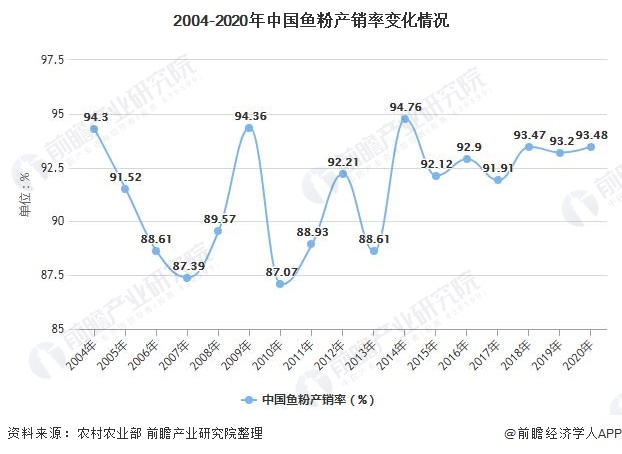

To sum up, from 2004 to 2020, the production and sales rate of fishmeal in China's market fluctuated, reaching a stage high of 94.76% in 2015. After 2015, the production and sales rate remained above 91%, and the growth rate of output was lower than the growth rate of sales. However, China's fish meal import dependence was high, and the dependence remained at about 70%, higher than that of corn and soybeans. The international supply of fish meal is adequate. The domestic fish meal industry is in urgent need of development, with tight balance between supply and demand.

5. The price of Chinese fish meal has entered the rising range

Affected by the small ban on catching, Peru's high-quality fish meal supply is tight, the port's fish meal inventory continues to decline, and manufacturers are willing to raise the price of high-quality fish meal. Since 2019, the domestic breeding industry has gradually stepped out of the impact of the African pig plague, the production capacity of live pigs, poultry, aquatic products, etc. has recovered, downstream feed demand has been boosted, the demand for fish meal has increased, and the price of fish meal has entered an upward range since the second half of 2019.

Influenced by the rising price of raw material fishmeal, the feed price will rise in 2020.