Pet industry research: 100-billion-level blue ocean, domestic substitution is accelerating

1 U.S. pet market: hundreds of billions of dollars in size, the U.S. leads the global market

1.1 The world pet market is nearly US$300 billion, with the United States being the largest market

The pet economy is booming, and the total pet market in the United States exceeds 100 billion US dollars. According to data from the American Pet Products Association (APPA), global pet market sales reached US$307.21 billion in 2021, of which the US market accounted for 40.2% of the world, reaching US$123.6 billion, ranking first in the world, far surpassing the second-ranked Brazilian market ( 5.2%). The U.S. market has grown steadily in the ten years from 2012 to 2021, with a CAGR of 9.79%, of which the growth rate in 2021 will reach 19.31%.

The penetration rate of pet ownership is as high as 70%, and the annual consumption of a single pet is as high as 1,358.98 US dollars. The United States has a long history of pet-raising culture, and pets have become an important part of residents’ lives. APPA's 2021-2022 National Pet Owners Survey data shows that among the nearly 130 million households in the country in 2021, about 90.5 million households have at least one pet, accounting for 70% of the total households in the country, mainly dog- and cat-raising households. , 69 million households and 45.3 million households respectively, accounting for 44.72% and 29.36% of all pet types. In addition to the huge number of pets, per capita pet consumption in the United States has also remained high all year round. In 2021, the average annual pet expenditure for pet-owning households reached $1,358.97. Among common pet types, dogs are relatively more expensive. Households with dogs spend an average of US$1,480 a year, which is 64% more than households with cats.

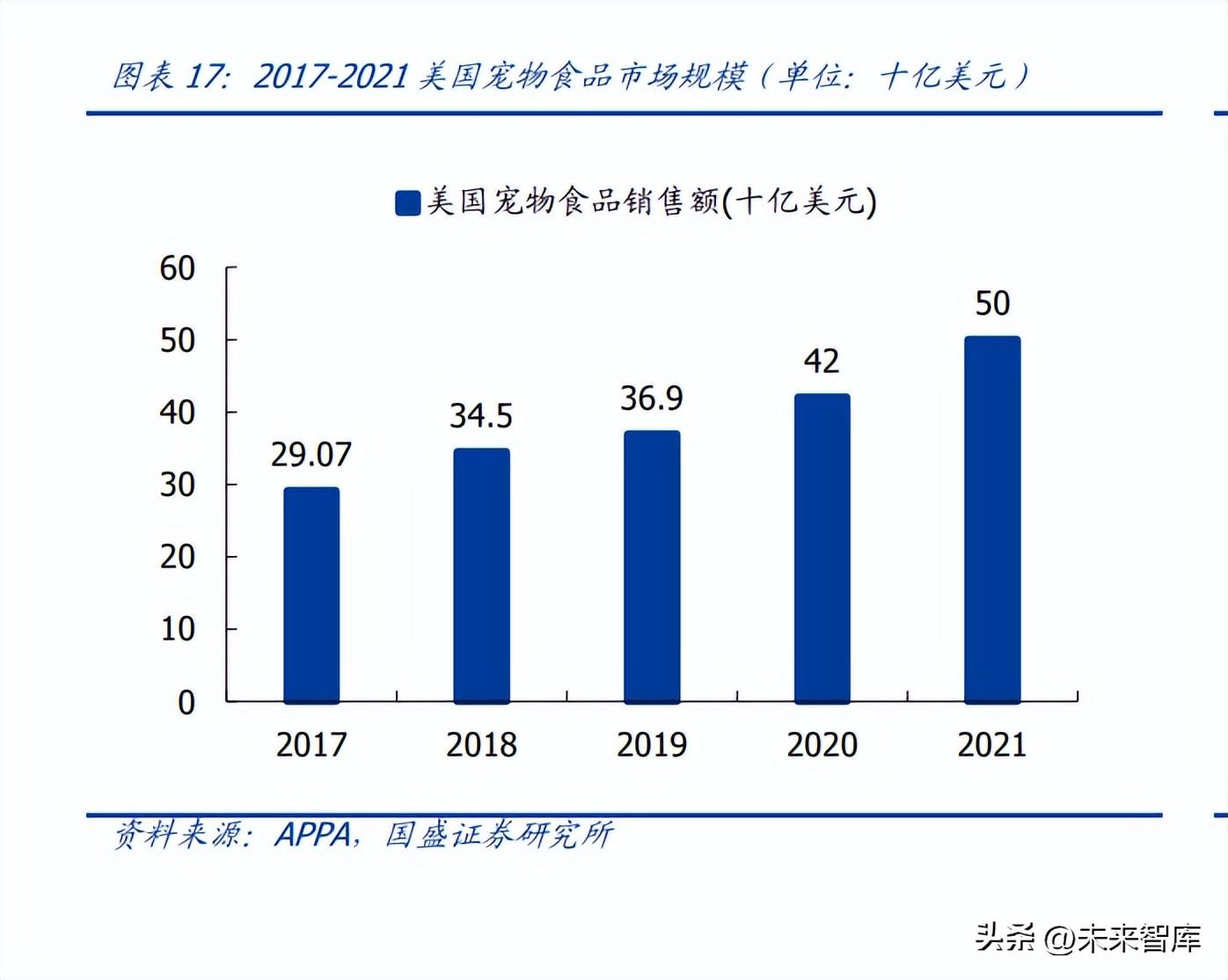

Pet consumption consists of four major market segments, with pet food occupying the largest share. Pet raising is a multi-dimensional service demand. The pet market is mainly composed of four sub-sectors: pet food, pet supplies (including pet medicines, pet accessories), pet services (covering veterinary care, beauty, etc.) and live animal trading. Among them, pet food accounts for the largest share. APPA data in 2021 shows that of the US$131.5 billion in pet consumption in the United States, spending on pet food and snacks reached US$50 billion, accounting for 40.5% of total consumption, a year-on-year increase of 13.6%. Pet service sales ranked second with US$43.8 billion, of which veterinary care and product sales were US$34.3 billion, with a market share of 27.8%, a year-on-year increase of 8.9%; other services totaled US$9.5 billion, accounting for 7.7% of the market. A year-on-year increase of 17.3%. Sales of pet products and live animal transactions were US$29.8 billion, accounting for 24.1% of total consumption and a growth rate of 17.8%, making it the sector with the largest year-on-year growth among all types of consumption.

1.2 Industry historical review: a century of steady development, laying the foundation for global leadership

1.2.1 Emerging period (1900-1980): Capitalist industrialization promoted the urbanization process and stimulated the emergence of the pet industry

Industrialization drives the commercialization of the pet industry. The period from the early 20th century to the 1980s was the budding period of the American pet industry. Since the industrialization of American capitalism in the mid-to-late 19th century, the United States has generally implemented machine production and developed a relatively complete factory processing system. In 1860, James Spratt invented the world's first commercial pet food, Spratt's Dog & Puppy Cakes, followed by the advent of the first canned dog food, Ken-L Ration, in 1922 and the first puffed pet food produced by extrusion in 1956. , making consumers realize the high cost performance and high convenience of machine-produced pet food. Commercial pet food has taken the market by storm, gradually replacing the early pet rations that were mainly raw meat and human food leftovers. Rapid economic development has driven the growth in demand for pet ownership. After the second industrial revolution in the mid-to-late 19th century, the United States basically completed the urbanization process. The rapid economic development has greatly improved the material living standards of residents, and the urban population has increased their pursuit of spiritual living standards. Pets serve as carriers of human spiritual life and emotional needs. In the context of economic development, humans' love and acceptance of pets have increased sharply, making them an important part of residents' lives. The increasing awareness of pet ownership and the gradually increasing penetration rate of pet products have spurred the emergence of the US pet industry.

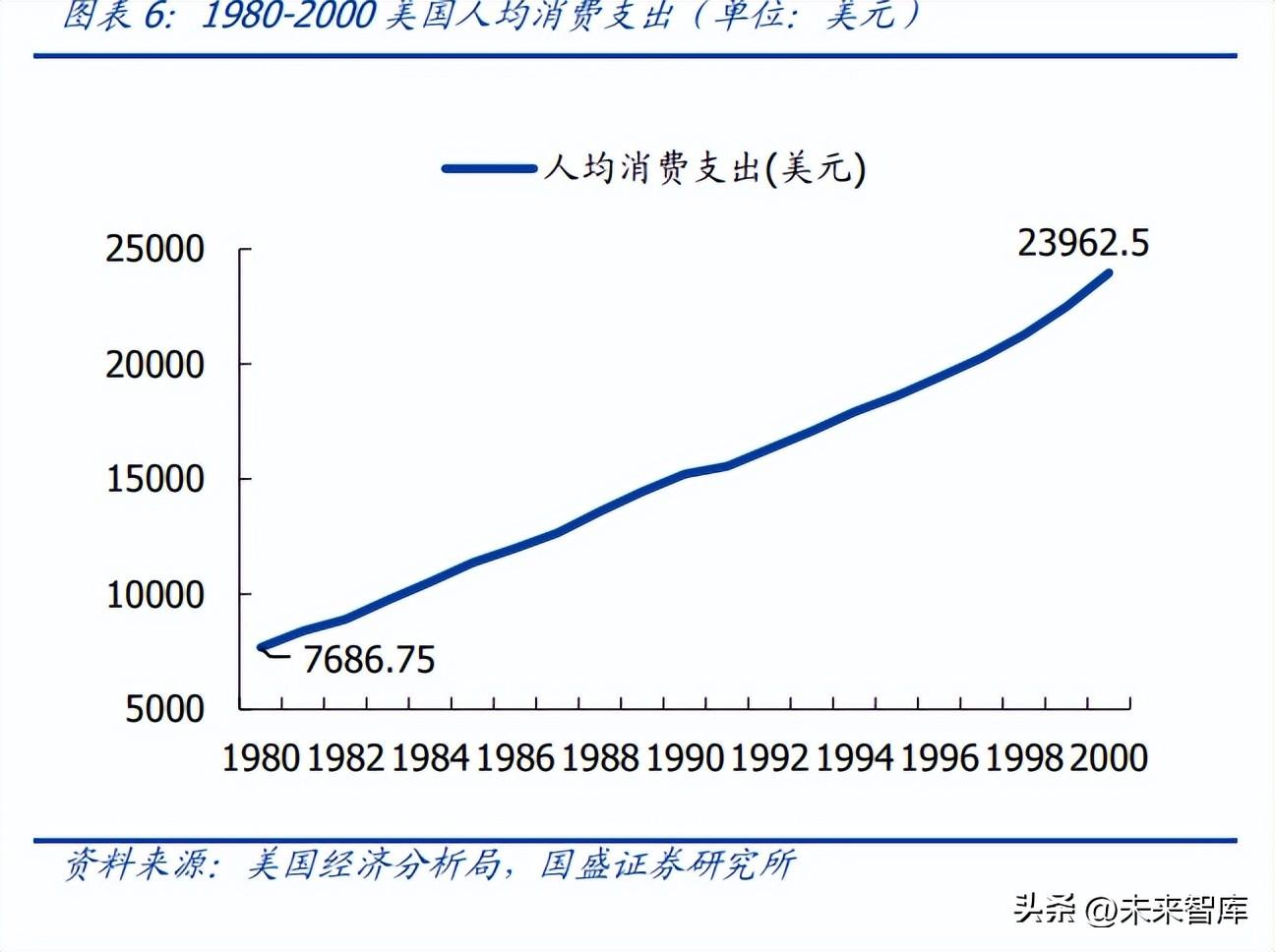

1.2.2 Rapid growth period (1980-2000): The golden age of the economy drives the diversified development of the industry, and the leader of the retail industry is formed

The per capita consumption expenditure has increased significantly, laying the foundation for the golden development of the pet industry for 20 years. The 1980s was the golden age for the development of modern industry in the United States. At that time, the United States was getting rid of the stagflation of the 1970s. The new President Reagan implemented a large-scale tax cut policy, reducing personal income tax and corporate tax to stimulate investment. At the same time, the social security system Gradually improving, the population structure has changed significantly, becoming the driving force for increasing consumer demand. From 1980 to 2000, U.S. per capita consumer spending increased 2.1 times. In a social context with rising consumption levels, the proportion of households with pets continues to increase. The pet industry has ushered in opportunities for industry growth. The increase in the number of pet owners and the increase in pet consumption have jointly promoted the expansion of the pet industry. Traditional pet retail stores The rise has led to the consumption of pet animal health and services. Most of today’s leaders in the pet segment were born during this period, with the most representative companies being PetSmart and PetCo. PetSmart was founded in 1987. It started with two offline pet stores in Las Vegas. It uses a unique pet products sales model Petfood Warehouse (super large warehouse-style pet food store) and acquisition strategy to rapidly expand stores and expand its global presence. , has become the world's largest comprehensive pet products retail and service chain store. PetCo also seized the opportunity of the times, quickly laid out the pet track in the 1980s, actively expanded its business, and built a chain pet retail organization. VCA, a leading pet hospital, was also founded during this period. In 1994, the total consumption of the US pet industry was US$17 billion. By 2001, it had exceeded US$28 billion, with a compound annual growth rate of 7.6%.

1.2.3 Steady growth period (2000 to present): Multiple factors support the continued growth of pet-raising demand, and pet consumption upgrades are in progress.

The "personalization" of pet products highlights the emotional needs of residents, and consumption upgrades promote the continued expansion of the industry. Since the 21st century, the American pet industry has entered a period of rapid development. With the advancement of the times and the update of social culture, the pet economy has developed in the direction of "emotional economy", and the adhesion of emotion in consumption continues to increase. "Pet humanization" has become the mainstream of the US pet industry. More and more pet owners regard pets as one of their own family members. The family status of pets continues to improve, which also promotes the overall consumption upgrade of the pet industry. Due to the differences in the pet-raising habits of pet-raising people, and the different characteristics of different breeds and even different individual pets, in order to meet the differentiated needs, the personalized consumption characteristics of pet products are constantly highlighted, and "high-quality, professional, and customized" have become consumers' Focusing on the core elements, high-quality, healthy and technological products are favored by more consumers. In addition, because pets have strong social attributes, diversified services around pet grooming, pet foster care, and pet medical care have entered the field of pet owners' vision, and the pet industry service chain has expanded rapidly. The changing trend of population structure is positively correlated with the penetration rate of pets. The 65 and older population includes the Baby Boomers (58 and 76 years old) and the Builders (77 and older). According to the U.S. Census Bureau, the share of the population aged 65 and older has been rising since 2008, reaching 17.04% in 2021. There are more than 56 million seniors in the United States. A survey report by the American Pet Products Association shows that the proportion of U.S. households with pets has increased from 58% in 1988, the first year of the report, to 70% in 2021. By comparing the growth in the proportion of the elderly population and the increase in the penetration rate of pet ownership, the correlation between the two is high. The U.S. Census Bureau predicts that the aging rate will rise to 21 percent in 2030 as the entire baby boomer population reaches age 65 or older. It is speculated that the number of households raising pets will further increase.

The wave of singles drives the pet economy to explode. Millennials (26-41 years old) are the age group with the highest proportion in the United States. According to Census Bureau data, there are 72.9 million Millennials in 2021, accounting for 24.43% of the total population. Compared with previous generations, it takes longer for Millennials to get married or start a family. The proportion of single-person households among the younger generation has increased, and the proportion of single-person households is on the rise. As of 2021, there are 36.87 million single-person households in the United States, accounting for 30.19% of all family structures. Changes in the Millennial generation’s views on marriage and love have a long-term impact on the trajectory of the U.S. pet market. Compared with people over 42 years old, this generation has a stronger willingness to keep pets and consume more pets. At the same time, the average disposable income of Millennial households has reached US$84,563, ranking second among all generations, second only to Generation X who benefited from the rapid economic development in the golden age and have certain asset reserves. Millennials’ abundant income reserves and strong willingness to keep pets and consume have led to explosive growth in the pet economy in the past six years.

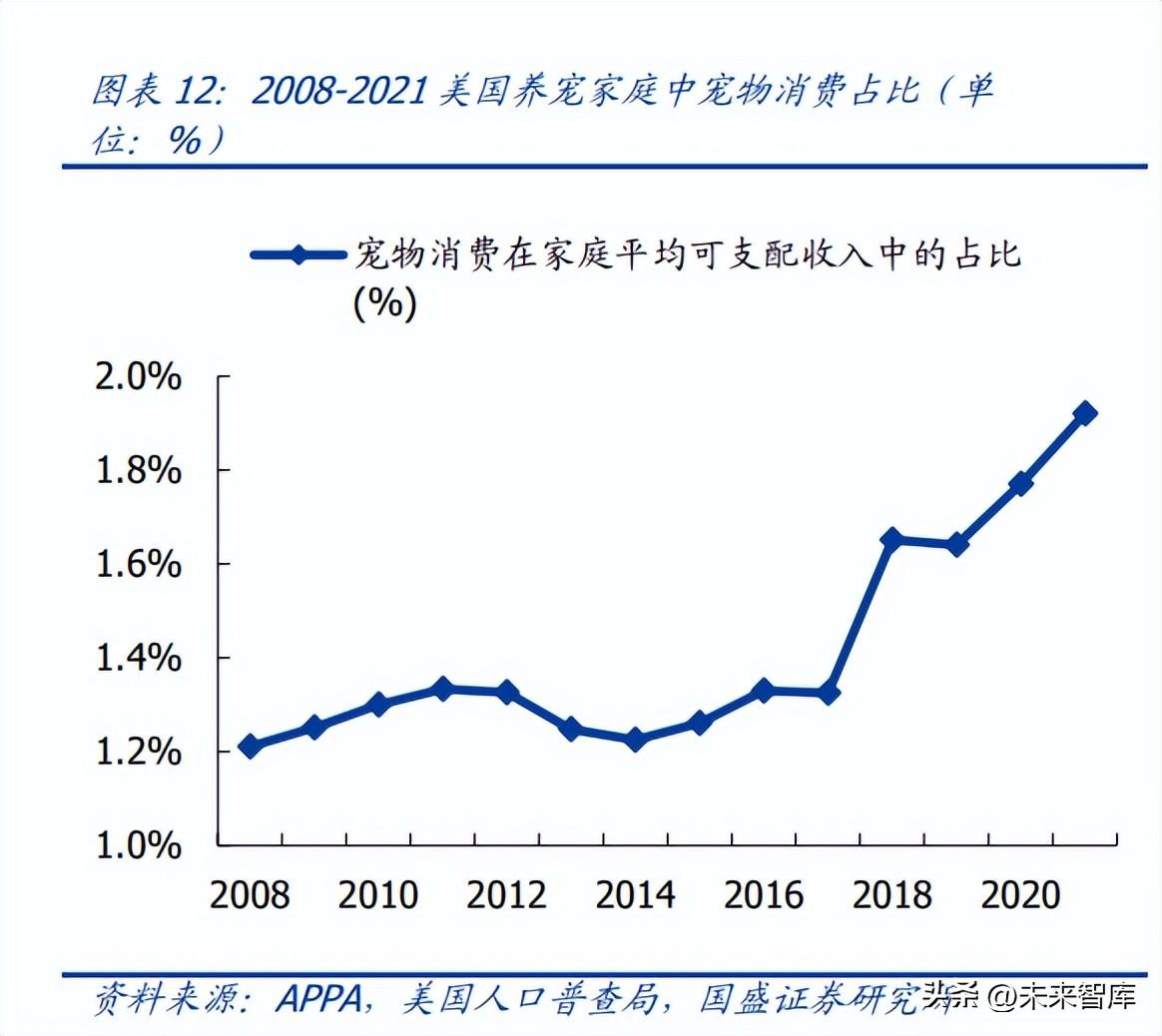

The demand for pet consumption is growing rapidly, and the proportion of pet consumption in household disposable income is increasing. Pet demand elasticity is used to reflect the consumption willingness of pet owners. Morgan Stanley's pet animal health industry report shows that from 1990 to 2006, the average demand elasticity for pets was 3.6, that is, for every US$1 decrease in real disposable income, pet expenditures fell by US$3.6. By 2014-2019, the elasticity of demand for pets dropped to 1.7; at the same time, the proportion of pet consumption in household disposable income also increased from 1.21% in 2008 to 1.92% in 2021. According to data from AlphaWise, 37% of pet owners surveyed are willing to take out loans to pay for their pets’ expenses, and 29% of pet owners put their pets’ needs before their own. Based on the previous article in this report, population structure and social trends promote the penetration rate of pet ownership, while economic conditions and consumption willingness determine the spending power of pet owners. As residents' emotional needs for pets increase and pet owners have higher standards for the quality of their pets' food, clothing, housing and transportation, it is expected that the pet market will continue to develop strongly.

The increasing proportion of millennials is one of the driving factors behind the e-commerce trend. In recent years, the proportion of consumers purchasing pet products online has increased significantly. According to Statista data, in 2020, online buyers of Amazon pet products accounted for 60%, Chewy pet products online buyers accounted for 54%, and PetSmart pet products Online buyers accounted for 27%. E-commerce consumption is the only way for the development of the pet industry: 1) As the epidemic continues to rage, people have begun to reduce the frequency of going out for shopping, and e-commerce consumption has become mainstream; 2) The switch in the demographic structure of American society has brought about a significant change in the age composition of pet owners. Variety. APPA data shows that among pet owners, Millennials and Generation Z people born after 1981 account for more than 40%. The consumer group is getting younger. The e-commerce shopping habits of young consumers have migrated to pet consumption, enhancing the popularity of pets. The general trend of consumer e-commerce. 3) As the dividends of the e-commerce market are reflected, major leading and emerging companies are focusing on the field of pet e-commerce, vigorously building warehousing logistics facilities and online shopping ecology, improving order efficiency, building e-commerce brand power, and optimizing user e-commerce. shopping experience, further promoting the e-commerce of pet consumption.

Pet consumption is less affected by the economic cycle and has strong growth resilience. During the financial crisis in 2008, the U.S. pet industry remained strong. Pets serve as emotional support for pet owners. Pet owners are more willing to cut personal expenses before pet consumption. The revenue growth rate of the pet industry is ahead of other retail industries. In 2009, when the GDP per capita in the United States dropped by 2.71% year-on-year, the sales volume of the pet industry increased year-on-year. An increase of 5.32%; according to Huanya Economic Data, in 2010, when the macroeconomic performance was poor, U.S. entertainment consumption fell by 7%, food consumption fell by 3.8%, housing consumption fell by 2%, clothing and service consumption fell by 1.4%, while pet consumption fell An increase of 6.2%; the same is true during the COVID-19 pandemic since 2020. The demand for companionship caused by home isolation has surged, and the number of pets and pet consumption have increased instead of decreasing. In the American Pet Products Association’s special study on the COVID-19 epidemic, about 9% of respondents said they purchased a new pet during the COVID-19 epidemic, equivalent to approximately 11 million new pets in the market. The expansion of the industrial chain and the improvement of consumer quality have rapidly promoted the development of the pet industry.

1.3 Pet food: the largest market for pet consumption, with high industry concentration

1.3.1 50 billion high-quality track, food is a rigid demand

Pet food consumption is relatively rigid. The U.S. pet food market is the segment with the largest share of the pet market, with a total sales volume of US$50 billion in 2021, accounting for 40.5%. Since pet food has the characteristics of rigid demand, it is less affected by the economic cycle. During the economic recession, pet owners still pay attention to the choice of pet food. During the COVID-19 epidemic, most residents work from home, and pet owners have more time to interact with their pets. Food feeding is one of the first choices for most pet owners to enhance their relationship with their pets. At the same time, the booming online shopping method provides convenience for pet owners to purchase food while at home. Therefore, the pet food market continues to expand, with a CAGR of 14.52% during 2017-2021, and a growth rate of 19% in 2021. The U.S. pet food market share is second to none in the world. Statista data shows that the global pet industry market size will be US$245 billion in 2021, of which pet food sales will be US$115.5 billion, with a market share of 47.14%. The pet food market has the largest market size in the world. In the global pet food market profit ranking released by Statista in 2021, the United States topped the list with a profit of US$43.6 billion, accounting for 46% of the global market, ranking second. It is nearly 7 times more than the United Kingdom (USD 660 million), even exceeding the combined markets of Europe, South America and other continents.

1.3.2 Staple food and dog food maintain the first place in the pet food category, and the demand for high-quality products grows

Staple food occupies the main market of pet food, and snacks show a rapid growth trend. Pet food is mainly divided into dry food (i.e. puffed food), wet food (including semi-moist food and canned food), snacks (including chews such as jerky and bones), and other foods including frozen food. Among them, dry food and wet food are the main food. Dry food is mostly made of meat powder or meat by-products, starch, grains, etc., with less water and is easy to store; wet food is mainly composed of meat and offal of poultry and livestock, starch, fruits and vegetables, and contains water. The content is higher and the nutrition is richer. Snacks, as snack foods in addition to staple food, are mainly used to reward pets occasionally. Taking dogs and cats as an example, IRI data shows that among U.S. dog and cat pet food in 2021, calculated based on the number of bags of food consumed by a single pet per year, the annual number of bags of wet food due to the small net weight of each bag of product (average 0.8 pounds/bag) Sales volume accounts for the first place, accounting for 63.32%; dry food is usually packaged in large packages (average 30 pounds/bag), accounting for 14.15% of sales; snack sales account for 20.95%. As the main source of nutrition, staple food sales account for nearly 80%. However, this data may be declining year by year due to the strong rise of snacks. Pet treat sales in 2021 were $942 million, up 5.96% from 2020. In comparison, both dry food and wet food sales showed a downward trend year-on-year, with dry food sales falling by 3.20% and wet food sales by 0.97%. In terms of sales scale, dry food sales in 2021 will be US$20.144 billion, accounting for 45.53%. The sales of wet food and snacks were 27.44% and 24.54% respectively. Dry food is still the most popular type of food on the market due to its low price per pound and easy storage. However, in the long run, the dry food market is shrinking. In 2021, dry food sales decreased by 1.35% year-on-year, while wet food and snacks increased by 10.05% and 10.34% respectively. The high growth of snacks may be due to the increase in interaction between owners and pets. In recent years, the popularization of pet psychology and behavior and the increase in time spent at home during the COVID-19 epidemic have prompted pet owners to increase the time they spend interacting with their pets. As a reward food after interaction, snacks are becoming more and more popular. are increasingly demanded by consumers. Snack sales are expected to equal that of wet food in 2022.

In terms of pet animal types, dog food accounts for a large proportion and the consumption amount is high. Dog and cat food are the two main categories of pet food in the United States, among which dog food has the largest sales volume. According to Euromonitor statistics, total dog food sales in 2020 were US$26.5 billion, accounting for approximately 69.37% of the pet food market. Total sales of cat food were US$10.7 billion, accounting for 28.01%; sales of other pet food were US$1 billion, accounting for 2.62%. There are two reasons why dog food accounts for a large share of the market. First, in terms of price, the average selling price of dog food products is generally higher than that of cat food products; second, in terms of quantity, the number of dog-raising households in the United States is higher than the number of cat-raising households, and the relative size of dogs They are large and eat a lot, so dog owners have a greater demand for pet food than cat owners.

The demand for high quality and functionality has become a new trend in pet food consumption. In recent years, pet owners have become increasingly concerned about their pets' needs. Pet owners’ selection criteria for pet rations have evolved from simply being full to paying attention to nutritional combinations and disease prevention. Products with high-quality food, pure natural ingredients or specific functions (such as preventing hair loss, etc.) are very popular among pet owners. A Statistia survey shows that 55% of consumers in the United States hope that pet food can improve digestion, 51% are concerned about musculoskeletal health, 46% hope to be beneficial to coat health, and 45% are interested in improving immune function. At the same time, consumers have a high preference for sustainable and environmentally friendly products, with 51% of pet owners saying they are willing to pay more for such products. Changes in consumer preferences are driving the market towards high-quality, functional and environmentally friendly packaging. Take probiotics as an example, because in recent years most consumers believe that probiotics can help improve pets’ digestive system, immune system, periodontal health, etc. In a report by PetFoodProcessing, probiotics were added to U.S. pet food products from 2017 to 2019 The proportion increased by 97%. Of the 169 new products launched in 2020, 52 contained added probiotics.

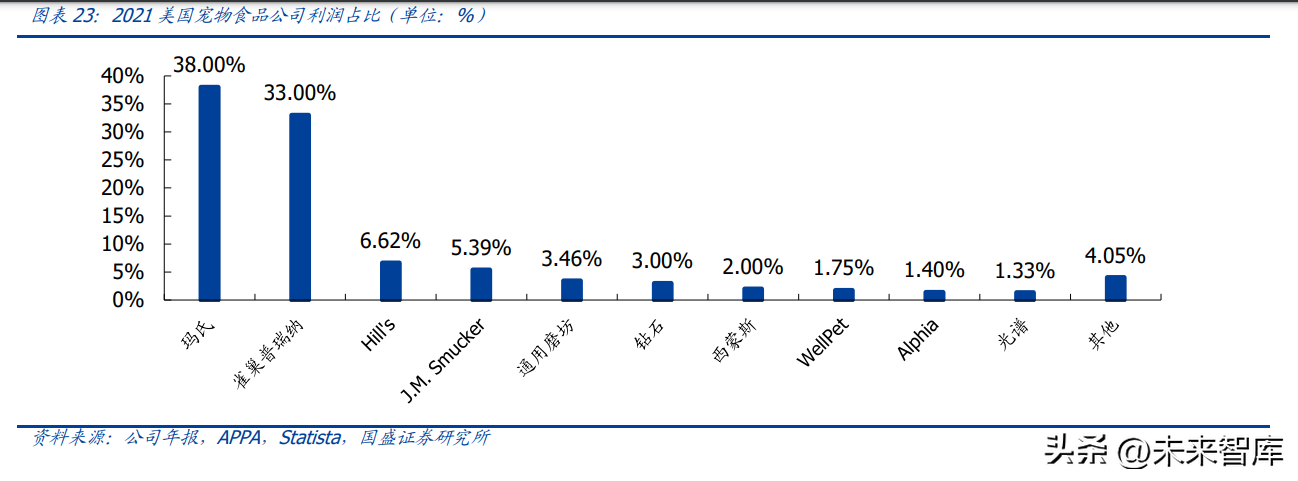

1.3.3 The pet food market is highly concentrated and leading companies have obvious advantages.

CR2 reached 71%, leading the industry to develop both internally and externally. The leading companies in the US pet food market have a high market share, with CR10 reaching 95.95% and CR2 reaching 71% in 2021. The U.S. industry leader also occupies a leading position in the world's pet food market. Eight companies including Mars, Nestlé Purina, and J.M. Smucker are also among the top ten in terms of global market share. Industry leaders have relatively comprehensive product coverage, high visibility and mature sales channels. Its advantage lies in its strong financial reserves and scientific research capabilities. Take Mars as an example. As early as the 1960s, Mars began scientific research on animal nutrition and dietary preferences, and formally established the Waltham Pet Care Science Institute in 1965. On the other hand, leading companies entered the market earlier and quickly deployed the market through mergers and acquisitions. They usually choose established brands with a certain scale. Take Mars as an example. Since the 1930s, Mars has entered the pet market by acquiring CHAPPIE® canned dog food in the UK. As of the date of publication of this report, Mars has completed the acquisition of nineteen targets, including Pedigree acquired in 1968 and Pedigree acquired in 2001. The acquired Royal Canin is still the main driver of Mars' revenue. In November 2022, the company announced the acquisition of Canada's Champion Petfoods. The acquisition is expected to be completed in the first half of 2023. Its ORIJEN Original Predation Desire and ACANA Aikenna The brand enjoys high popularity among pet owners around the world and is expected to bring new revenue growth to Mars.

The products of leading enterprises cover a comprehensive range. Another determinant of the high market concentration in the U.S. pet food industry lies in the optimized product lines of leading companies. Its segmented products cover dog food, cat food, bird food, fish food, as well as dry food, wet food, snacks and other pet products, covering low, medium and high markets. The price per kilogram of mid- to low-end products is about US$3-5 for staple grain products and US$5-12 for snack products. The price per kilogram of high-end products is about US$6 for staple grains and more than US$12 for snacks. Mars owns more than 50 pet food brands in CR2, while Nestlé Purina’s premium brands Purina Pro Plan, Purina ONE and Felix are performing strongly, as are newly acquired brands such as Tails.com and Lily’s Kitchen.

Consumers have high trust in brands. According to the APPA survey, more than two-thirds of consumers believe that brands are of high importance in choosing pet food, and more than half of consumers consider themselves loyal customers of a certain brand. Thanks to the comprehensive product coverage of leading companies, the U.S. pet food industry segment is basically saturated. The functional food market is dominated by Mars (focusing on improving immunity) and Nestlé (early development, intestinal health and elderly cognition), JM Sumker is known for the taste and novelty of its pet treats. Leading brands have successfully established brand effects and cultivated high consumer brand loyalty through their familiarity with the market and comprehensive layout of market segments.

1.4 Pet Medical Care: Demand habits are highly sticky, and the animal health care industry is the leader

1.4.1 The market size is tens of billions, and veterinary institutions and animal health products share the market

Pet medical care includes pet veterinary institutions (dentists, medical and surgical diagnosis and treatment, routine physical examination reports, etc.) and pet animal health care (medicines and vaccines). APPA data shows that the pet medical market size in the United States will exceed US$34.3 billion in 2021 (the scale of some over-the-counter veterinary drugs cannot be accurately calculated due to ambiguous classification), accounting for 27.8% of the total market, with a year-on-year growth of 9.24%. The demand for pet veterinarians is highly sticky, and private hospitals occupy a high share. By type, veterinary institutions are usually divided into four categories: regular hospitals, walk-in clinics, disease testing centers and laboratories. According to the nature of business, they can be divided into brand chains and individual private businesses. According to GrandView data, private veterinary hospitals accounted for more than 60% of the largest share of the US veterinary market in 2021. This trend is in line with the characteristics of American society and national conditions. American family residential and commercial districts The geographical division is obvious. Compared with large hospitals, private clinics have the advantages of less passenger flow, timely treatment, strong service, and high privacy. At the same time, driven by high demand and high return on investment, a large number of veterinarians engage in private clinical practice. On the other hand, pet veterinarians are accustomed to high demand. A survey conducted by the American Veterinary Medical Association (AVMA) in 2019 showed that 44% of pet owners said that veterinarians are their main source of pet nutrition information, while 64% of pet owners Then strictly follow the veterinarian's instructions to take care of the pet's diet and living habits. However, approximately one-third of current professional veterinarians are over the age of 58 (data from GrandView), and 20% of current veterinarians are expected to retire within the next decade. The reduction in the number of existing veterinarians and the high sticky demand for veterinarians are expected to increase the market size of veterinary institutions in the next few years.

1.4.2 Pet animal health in the United States is mature and highly monopolistic

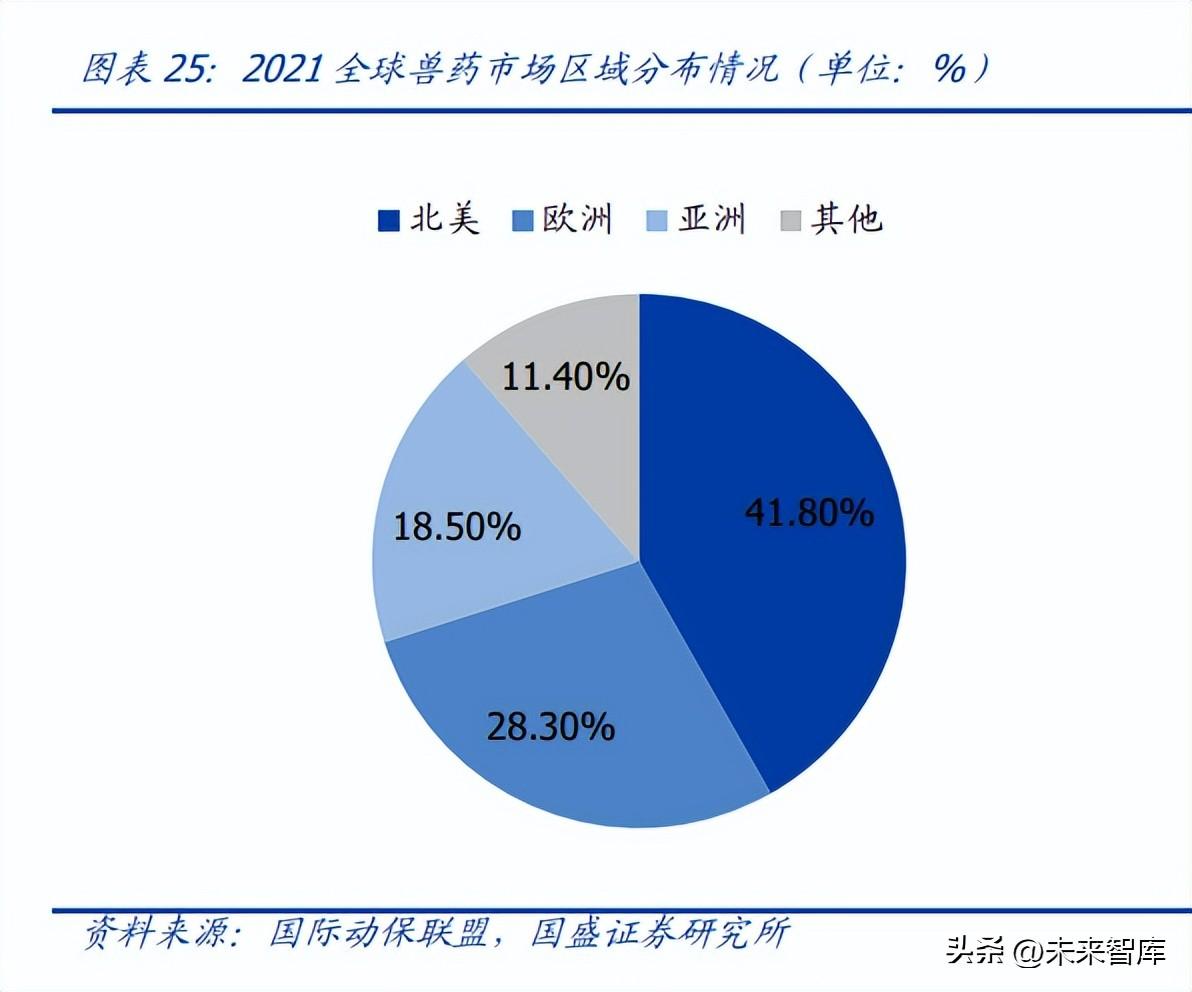

The average annual cost of canine veterinary care in the United States is $745. The U.S. animal health industry is mature and is the world's largest animal health market. The market share of the North American market in 2021 will be around 41.8%, with an expected growth rate of 9.2% (International Animal Health Alliance, Vetnosis data). Livestock animal health and pet animal health each occupy half of the market. In recent years, with the increase in pet penetration, pet animal health has shown a rapid development trend. Taking veterinary drugs as an example, pet veterinary drugs have occupied an important position in the entire veterinary drug market, with a market share of 40% in 2020. The trend of "pet humanization" has prompted pet owners to pay more attention to pet health year by year, and per capita pet animal health expenditures continue to increase. In 2021, the average annual consumption of canine veterinary care (including diagnosis and treatment, medicines and vaccines) and nutritional products in the United States is US$745. Compared with a 49% increase ten years ago, the average consumption of cats is US$455. It is expected that the United States will continue to maintain its leading market share. In addition, the mature urbanization process has led to a high prevalence of pet diseases, and the demand for such innovative drugs and vaccines has driven the growth of the US pet animal health market.

The market share of veterinary drugs in this segment is as high as 51.2%. The pet animal health industry can be subdivided into three major sectors: pet veterinary drugs, pet vaccines and medicinal feed additives. Among them, veterinary drugs are the largest segment. According to data from GrandView, in the North American pet animal health industry, veterinary drugs accounted for 51.2% in 2021, a year-on-year increase of 5.87%. Pet vaccines ranked second, accounting for 16.0% of the total market, with a year-on-year growth of 5.61%. Feed additives and medical treatment expenses accounted for 15.6%/14.75% respectively.

Pet medicines include anthelmintics, anti-inflammatory drugs, antibiotics, analgesics, etc. With the basic improvement of the urbanization process, pets have shifted from free-range to domestic. Pet diets, behaviors, and social relationships have changed significantly compared with the wild free-range period, making modern pets susceptible to food-borne, psychiatric, or low immunity. disease. Common small pet illnesses include infectious diseases, skin diseases, allergies, loss of appetite, orthopedic disease and behavioral disorders. Increasing R&D activities and shorter drug life cycles play an important role in the growth of the pet drugs market. A GrandView survey shows that the average pet drug development cycle is about 3 years, while the drug development cycle for other organisms is between 7-15 years. Compared with human drugs, pet drugs are innovative and more sustainable.

The only compulsory rabies vaccine is the largest category of vaccines for dogs and cats. The use of vaccines to treat increasingly prevalent foodborne and zoonotic diseases is a driving force in the pet vaccine industry. In recent years, pet vaccines have been mainly used to protect pets from diseases such as tumors, distemper, and herpes. Pet vaccines are divided into core vaccines (strongly recommended) and non-core vaccines (appropriate vaccination according to the pet’s living conditions). The core vaccines for dogs include rabies, canine distemper, canine parvovirus, hepatitis, and kennel cough vaccines. The core vaccines for cats include feline rabies, feline rhinotracheitis, calicivirus, feline leukemia, and upper respiratory tract infection (URI) vaccines. . Among them, rabies vaccine, as the only compulsory pet vaccine in the United States, occupies the largest market share. Once rabies occurs, the fatality rate is 100%, and there is no effective treatment plan. Vaccination, as the only prevention method, effectively protects the health of pets and owners. According to the Centers for Disease Control and Prevention (CDC), vaccination has reduced rabies cases in pets in the United States by 23.57% in the past 20 years.

Cancer rates are rising in dogs, and cats are more susceptible to chronic disease. A survey by the American Veterinary Medical Association shows that compared with pets such as cats, dogs are more likely to suffer from malignant tumors and lymphoma. According to the Veterinary Cancer Society, approximately one in four dogs will be diagnosed with a tumor (benign or malignant) at some point in their life. Almost half of dogs over the age of 10 will develop cancer. In 2019, 65 million dogs and 32 million cats in the United States had cancer (Animal Cancer Foundation data). Cancer is the leading cause of death in 47% of dogs. Cats are less at risk from cancer than dogs, however cats are susceptible to chronic health conditions such as cardiovascular disease, diabetes and kidney disease. Since such diseases are highly risky and difficult to cure, prevention or long-term stabilization treatment is usually the main approach. It is expected that pet cancer-related vaccines and chronic disease drugs will provide support for the growth of the pet animal health market.

1.4.3 Zoetis: Complying with the trend of pet economy, the market share ranks first

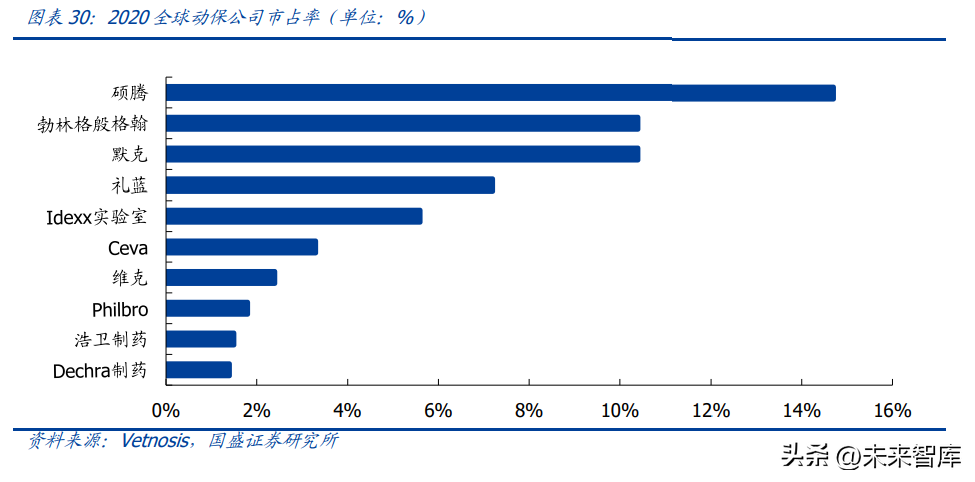

The international leader in animal health leads the rapid development of the pet animal health market segment, with high market concentration. The leader in the animal health industry is also in a leading position in the pet animal health industry. Since the 21st century, with the in-depth development of economic globalization and integration, the concentration of the veterinary drug industry has shown an increasing trend. Through continuous mergers, acquisitions and reorganizations, veterinary drug companies have formed international giants such as Zoetis, Boehringer Ingelheim, Merck, and Lelan Animal Health. Taking the 2020 International Animal Health Alliance data as an example, Zoetis continues to have a market share of 14.7%. Ranking firmly in the top spot, the global animal protection CR5 is 48.3%.

The pet segment is the main driver of Zoetis’ revenue growth. As the leading company with the largest market share, Zoetis is accelerating its deployment in the pet animal health sector. Since 2019, Zoetis’ revenue from the pet sector has gradually exceeded livestock revenue. In 2021, Zoetis’ pet segment revenue was US$4.689 billion, accounting for 60.3% of total profits, a year-on-year increase of 28.39%. Its pet animal health products include parasite protection products, dermatology products, analgesics, motion sickness medicines, vomiting treatment and other health products that improve the quality of life. The pet sector has brought considerable revenue growth to Zoetis. Zoetis announced that its revenue in 2021 will increase by 15% compared with the previous year, and this performance is mainly driven by its newly launched pet insecticide product Simparica Trio (YoY+82 %) and celebrity dermatology products.

In line with the trend of the pet economy, the global layout continues to advance. Zoetis has more than 300 product lines, 28 production sites and direct operations in more than 45 countries. As the world's leading manufacturer of pet and livestock medicines and vaccines, Zoetis has followed the trend of the pet economy and deployed globally. Among them, the pet sector has performed well. In markets including the United States, the United Kingdom, East Asia, Italy, etc., the revenue generated by the company's pet sector has exceeded that of livestock. plate. Zoetis's Rimady painkiller has occupied the largest share of pet painkillers in the EU since its launch, and is still on an upward trend.

2 Domestic pet market: The 100-billion-dollar blue ocean market has set sail, with many layout opportunities

2.1 The pet economy is booming and the Chinese market is rising rapidly

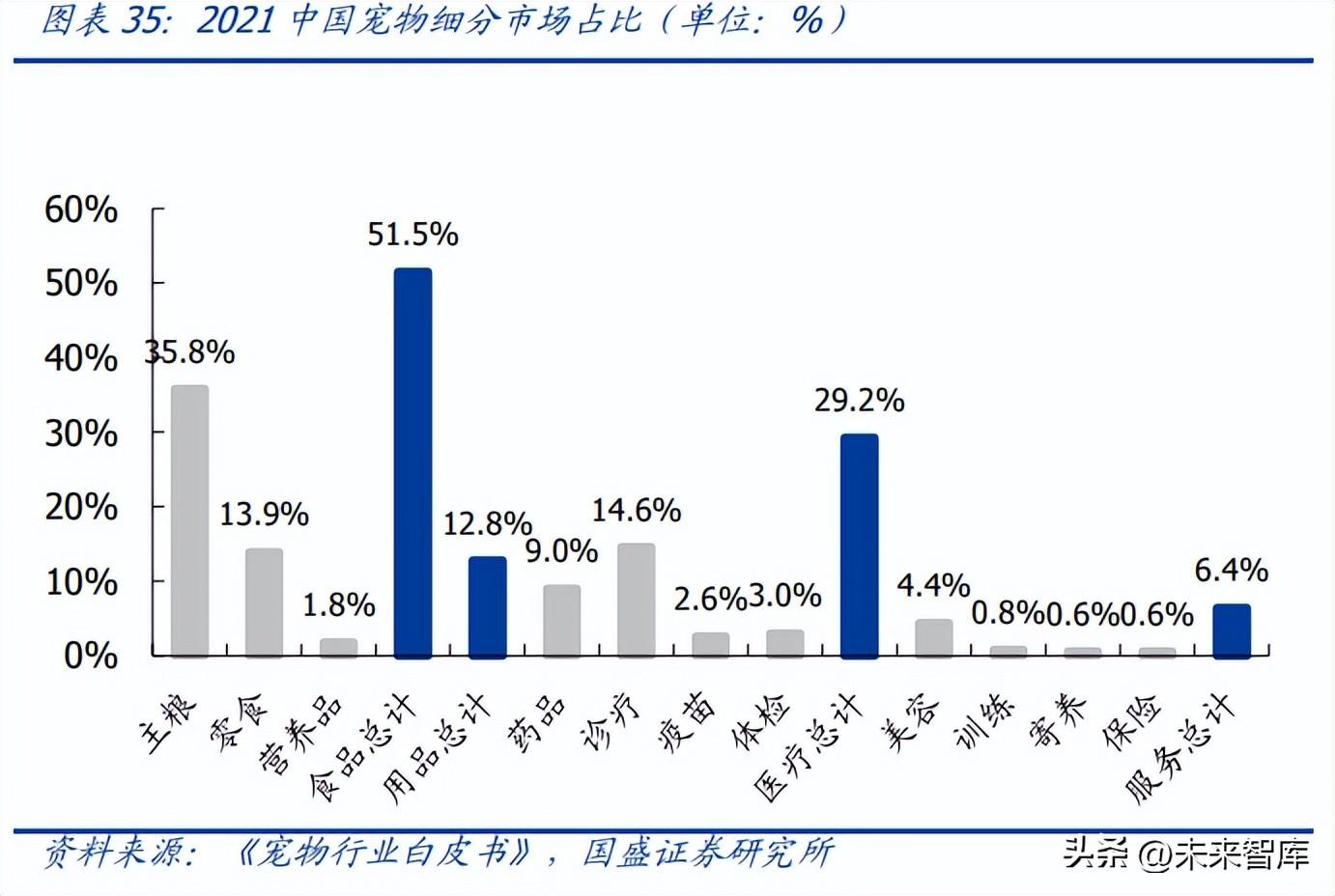

The market size exceeds 200 billion, and the pet economy is exploding. According to data from the "China Pet Industry White Paper" (hereinafter referred to as the "White Paper") jointly compiled by Paidu Pet and the Pet Industry Branch of the China Animal Husbandry Association, the scale of China's pet (dog and cat) market will reach 249 billion yuan in 2021 (the statistical caliber is The scale of the urban pet industry (excluding rural markets) increased by 20.58% year-on-year, with a compound annual growth rate of 27.4% over the past ten years. Only during the epidemic in 2020, the growth rate slowed down, but it still maintained positive growth. The market is in a period of rapid outbreak. Driven by policy, economic, social and technological factors, as well as more potential pet owners and emotional consumption brought about by the epidemic, the pet industry is expected to continue to maintain steady growth in the next three years. At the same time, with the rise of the Internet era and the standardization of industry policies, the pet market business model has become more mature. It can currently be divided into four major markets: pet food, medical care, supplies and services, with market shares of 51.5% and 29.2% respectively in 2021. %, 12.8% and 6.4%.

The penetration rate of pet ownership is only 1/3 of that in Japan and the United States, but consumption levels are expected to equal that. There are 91.47 million pet households in my country's cities and towns in 2021. According to the National Bureau of Statistics, there were 494 million households in China in 2020. The penetration rate of pet ownership in China is less than 20%, which is far behind developed countries such as the United States (70%), Japan (57%) and Europe (49%). However, the physical consumption of pet owners in my country has reached the same level as other countries, and the consumption of single pets has increased significantly. In 2021, the average annual consumption of a single pet in China is approximately 2,041 yuan, accounting for 6.73% of household consumption expenditure, while that in the United States is only 1.71%. From a global perspective, China's pet market in 2021 will only be 28.03% of the U.S. pet market, but its growth rate is three times that of the United States. Compared with the mature but slow-growing development trends in developed countries, my country's pet market is poised to gain momentum. The number of pets is far from saturated, and the cat economy is on the rise. According to the “White Paper” data, pet-raising households have an average of 1.8 types of pets, and the proportion of households with more than 2 types of pets is increasing. At present, the penetration rate of pets in China is still at a low level, and there is still considerable room for growth in the number of pets in the future. In terms of pet types, dogs and cats are still the main type of pets. Combined with the characteristics of China's dense urban population and the small average rented area in first- and second-tier cities, compared with the characteristics of dogs that need to be walked regularly and are lively and barking, raising cats has less potential nuisance problems and saves time and space. Therefore, raising cats in China The cat population is huge. In 2021, there were 58.06 million cats in urban areas, accounting for 59.5%. In the past four years, the CAGR reached 10.13%, surpassing dogs for the first time to become the most popular pet. Dogs ranked second with a total of 54.29 million, accounting for 51.7%, with a CAGR of 4.52% over the past four years.

2. 2 Industry development history: transition from barbaric growth to orderly growth

2.2.1 Enlightenment period (1990-1999): the ban on breeding was changed to the restriction, and the pet industry sprouted

China Small Animal Protection Association was officially established. my country's pet market started later than the markets in developed countries such as Europe, the United States, and Japan, and the development process is accompanied by the gradual relaxation of policies. Before the 1990s, due to epidemic prevention considerations, the Ministry of Health clearly stated that dog breeding was prohibited in cities above the county level, suburban areas, and emerging industrial zones. At the same time, residents had not yet established a complete concept and demand for pets. Dogs were mostly For home care and nursing homes, the demand for pets has not yet been discovered. In the early 1990s, Beijing issued the "Regulations on Strict Restrictions on Dog Breeding in Beijing" for the first time, changing the ban on dog breeding to restricted dog breeding. In 1992, the China Small Animal Protection Association was formally established, introducing the concept of pets as human companions for the first time, marking the initial formation of the domestic pet industry. Overseas giants such as Mars have entered the Chinese market. In 1993, the American pet industry giant Mars established the first pet food factory in China to produce Bolu dog food and Weijia cat food. Subsequently, brands such as Nestlé Purina's Connaught and Coraldo entered the Chinese market, and China's professional pet food market began form. During the same period, the first domestic pet stores, pet supplies and snack stores appeared in first-tier cities such as Beijing and Shanghai.

2.2.2 Incubation period (2000-2010): standardized industry policies and the emergence of new enterprises

Regulatory policies have guided the standardized development of the industry, standards in subdivided areas have been gradually refined, and the number of pets has increased significantly. First-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen have successively introduced policies to guide and regulate dog breeding, and the price of a dog breeding license has also been significantly reduced from 3,000 yuan to less than 1,000 yuan. In addition, in 2008, the General Administration of Quality Supervision, Inspection and Quarantine and the National Standardization Administration Committee issued two pet food standards on dog chew glue and dry food irradiation sterilization specifications, and pet food industry standards were gradually formed. Policies related to pet keeping are becoming more and more perfect, and the number of pets in my country is growing rapidly. From 2000 to 2010, the number of registered pets nationwide (urban and rural) rose from approximately 40 million to 96.91 million. Domestic emerging companies are emerging. Around 2002, many domestic pet food/supply companies focusing on foreign trade OEMs were established. Many representative pet companies such as Petty, Guabao Pet, and Birugi emerged and began to produce large-scale products. , mainly exporting products to Europe and the United States. At the same time, with the advent of the Internet era, online sales channels for pet-related products began to develop.

2.2.3 Rapid development period (2011 to present): Entrepreneurship boom rises, capital influx boosts rapid development of the industry

Pet-raising has opened up a "krypton gold" model, and the demand for pet consumption in lower-tier cities may continue to increase. Compared with developed countries (taking the United States as an example), my country's current pet market process can roughly be compared with the rapid development period of the United States in the 1980s. According to Euromonitor statistics, from 2010 to 2020, the number of cats per household in China increased from 0.04 to 0.19, and the number of dogs per household increased from 0.10 to 0.20. The growth in the number of pets and the refinement of pet keeping have driven up the consumption expenditure on single pets. The "White Paper" report shows that in 2021, the average annual consumption of a single dog in China was 2,634 yuan, a year-on-year increase of 16.5%; the average annual consumption of a single cat was 1,826 yuan, a year-on-year increase of 0.3 %. At the same time, urban office workers and the Internet have brought the consumption patterns of high-tier cities back to their hometowns. The overall improvement of the economic level of low-tier cities and the upgrading of the pet-raising concept of the younger generation have helped the development of the pet economy in the sinking market. In addition, users in lower-tier markets are more active on online short video platforms, and therefore they are the main group of "cloud-attracting pets". At present, this group may not have pets yet, but once the conditions are mature, their demand for pets will be released.

The trend of diversification in the pet industry is obvious. 1) Full life cycle industry chain coverage. Pet-raising has evolved from free-range to professional. Pet owners’ knowledge of pet-raising has improved and their consumption concepts have changed, which has promoted the upgrading of the consumption structure, thereby driving the development of more market segments in the pet industry. From 2010 to 2021, the pet market coverage has been upgraded from basic physiological needs to social needs and safety needs, involving pet breeding and trading, goods and services, and gradually developed a full industry chain covering pets' clothing, food, housing, transportation, birth, old age, illness and death, and basically formed an industrial chain. Closed loop, the current comprehensive level of my country's segmented track layout is on par with developed countries, which has become the basis for the increase in pet consumption.

2) The online and offline omni-channel model is gradually improving. The rapid development of self-media platforms such as Douyin and Xiaohongshu closely integrates traffic content with shopping, bringing incremental new potential to the development of brands and stores. “White paper” data shows that 44.1% of pet owners prefer to obtain pet-related information from e-commerce platforms. Consumption channels tend to be diversified, and there is no significant difference in online and offline consumer prices. Therefore, consumers are more inclined to choose consumption channels through their own shopping habits. The online advantage lies in convenience, while offline lies in the products and services or the explanations by professionals, which make it more experiential. While stabilizing their offline retail businesses, most pet brands and stores (such as Shengpet and Pet Home) use major Internet platforms to accelerate the strategic transformation of their omni-channel integrated business.

Driven by the triple drivers of economic foundation + demographic structure + social factors, China’s pet market is developing rapidly

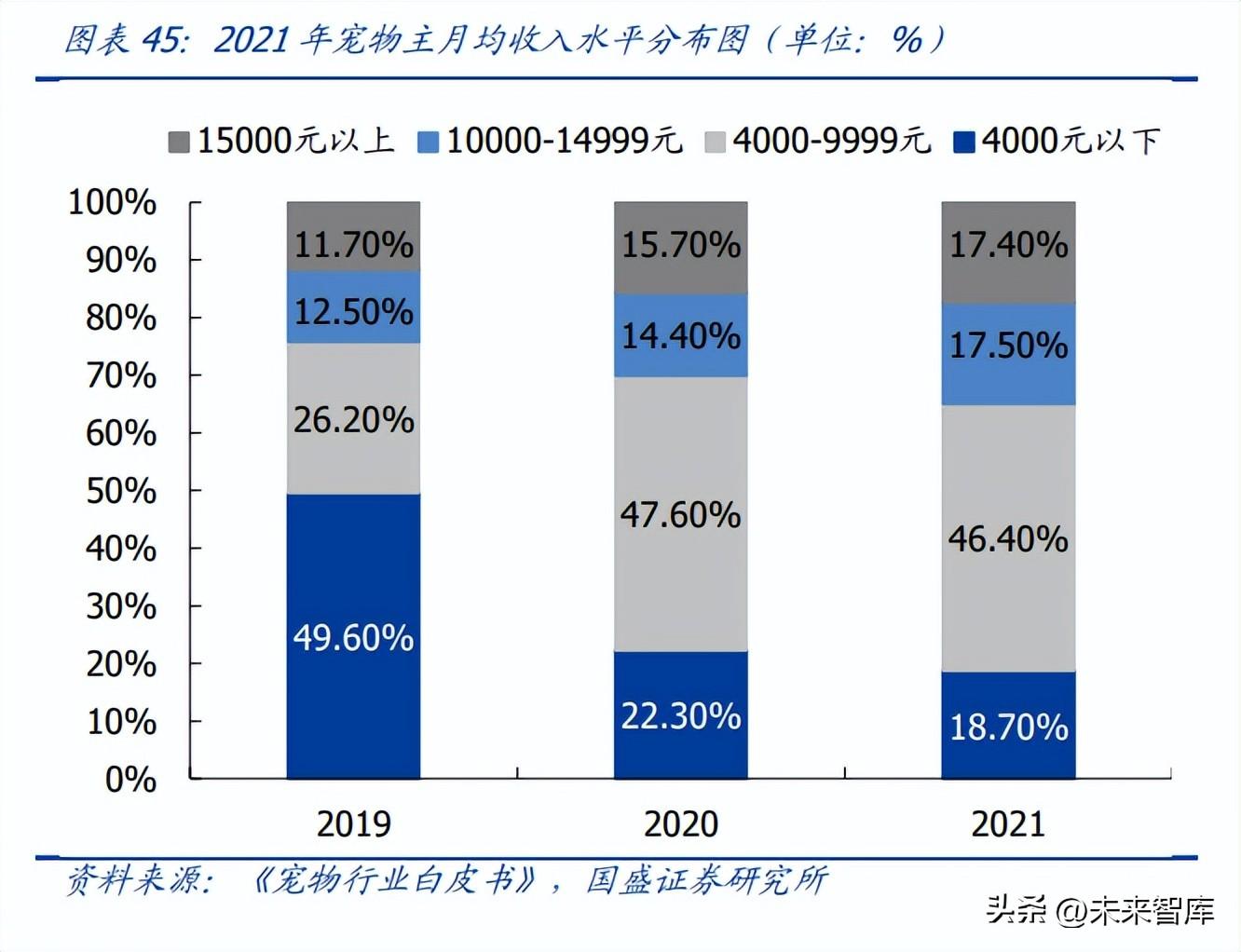

1) Per capita disposable income and consumer spending continue to increase. From 2010 to 2021, China's per capita GDP compound growth rate was 9.18%, the compound growth rate of urban residents' per capita disposable income was 8.78%, and the compound growth rate of per capita consumption expenditure was 7.65%. According to international experience, when per capita GDP reaches US$8,000, it indicates that the country’s urbanization pattern has been determined, the structure of residents’ consumption expenditure will undergo major changes, and the country will usher in an inflection point in consumption upgrading. my country's per capita GDP exceeded 8,000 US dollars in 2015. In 2021, my country's per capita GDP reached 80,976 yuan (11,300 US dollars), per capita disposable income reached 47,411 yuan, and per capita consumption expenditure was 30,307 yuan, which is directly proportional to the consumption scale of the pet market, indicating residents' consumption willingness As income increases, economic development and consumption structure upgrades provide the foundation for the development of the pet industry. At the same time, pet owners generally have high education, high income, and high consumption. The “White Paper” report shows that 62.6% of pet owners have a bachelor’s degree or above. Higher education has contributed to the continued increase in the monthly income of pet owners. The proportion of pet owners with an average monthly income of more than 4,000 yuan reached 81.3%, an increase of 30.9% from 2019; the proportion of pet owners with an average monthly income of more than 10,000 yuan reached 34.9%. The rising trend of pet owners’ education and income has pushed pet owners to pay attention to scientific, quality, and refined pet care, and pet expenses have continued to increase. In 2021, the proportion of high-spending people on pet care (that is, the average monthly consumption of staple food exceeds 500 yuan) will be 25 %, and the average pet-raising expenditure accounts for 6.73% of the per capita consumption expenditure of the urban population.

2) Aging drives the penetration rate of pet ownership to increase. The aging problem in our country continues to worsen. According to United Nations standards, if the number of people aged 65 and above in a country or region accounts for more than 14% of the total population, the country has entered deep aging. In 2021, the proportion of my country's population aged 65 and over will reach 14.2%, and the number of elderly people will exceed 200 million, meeting the standards for deep aging. Changes in the demographic structure have an impact on the economic structure of the pet industry. Due to factors such as modern children’s busy work, changes in fertility concepts, and most do not live with their parents, more elderly people in my country live alone (and most of them live in low-tier cities). Pets serve as emotional The carrier of sustenance can relieve the loneliness of the elderly. It is expected that the increasingly serious aging of the population will drive the penetration rate of pet-raising in urban areas, especially for the number of potential pet-raising households in low-tier cities.

3) Pet owners tend to be younger, and the single economy will support China’s pet consumption in the future. The "China Statistical Yearbook" shows that China's single population exceeded 240 million in 2019, and the number shows a continuous growth trend. The huge single group has spawned a new consumption system around them, and pets can provide companionship and sustenance for single people, and can relieve the pressure of work and life. For the single group, the attributes of pets as companion animals are highlighted. The white paper survey shows that pet owners born in the 1990s accounted for 46.3%, while those born in the 1990s and 1995s accounted for 54.5% of high-spending pet owners. Taking pet staple food as an example, young pet owners prefer freeze-dried food that is expensive and has excellent quality (38.3% of dog owners use freeze-dried food and 42.4% of cat owners), and the frequency of purchase is relatively high, with the frequency of stocking up ranging from 1 to 2 The proportion of monthly pet owners reached 52.9%. Nutritional ratio, ingredient composition, and palatability are the three major consumption decision-making factors for pet staple food. There is vast space for domestic substitution, and the rise of local brands is expected. Euromonitor data shows that the CR10 of my country's pet food industry in 2020 is 32.9%, which is still far behind the market concentration levels of Japan, South Korea, the United States and other countries. With the rapid development of the domestic pet industry, emerging local brands continue to emerge, gradually replacing mature European and American brands in the domestic first-mover market. Ultimately, brands with superior product research and development capabilities, supply chain systems, etc. are expected to become the leaders of the local industry, providing development opportunities. broad. In addition, the entry of capital is expected to further accelerate the development process of the industry. Qichacha data shows that there will be 58 financing cases in my country’s pet track in 2021, a year-on-year increase of 48.7%, and an increase of 57 cases compared with 2012. Among them, 16 cases clearly disclosed the financing amount. The total amount of financing exceeded 3.558 billion yuan.

2.3 Domestic pet food market: Occupying half of the pet industry, the “tide of domestic products” is rising

The scale of the pet food industry is growing rapidly, and staple food remains the first. The pet food market size in 2021 is 128.235 billion yuan, which has increased nearly 10 times in ten years, accounting for 51.5% of the industry category, making it the largest market segment in the pet industry. Domestic pet food is divided into three major segments: staple food (dry food and wet food), snacks and nutritional products. Among them, the scale of staple food is 89.142 billion yuan, accounting for 69.51%, the scale of snacks is 34.611 billion yuan, accounting for 26.99%, and the scale of nutritional products is 4.482 billion yuan, accounting for 3.5%.

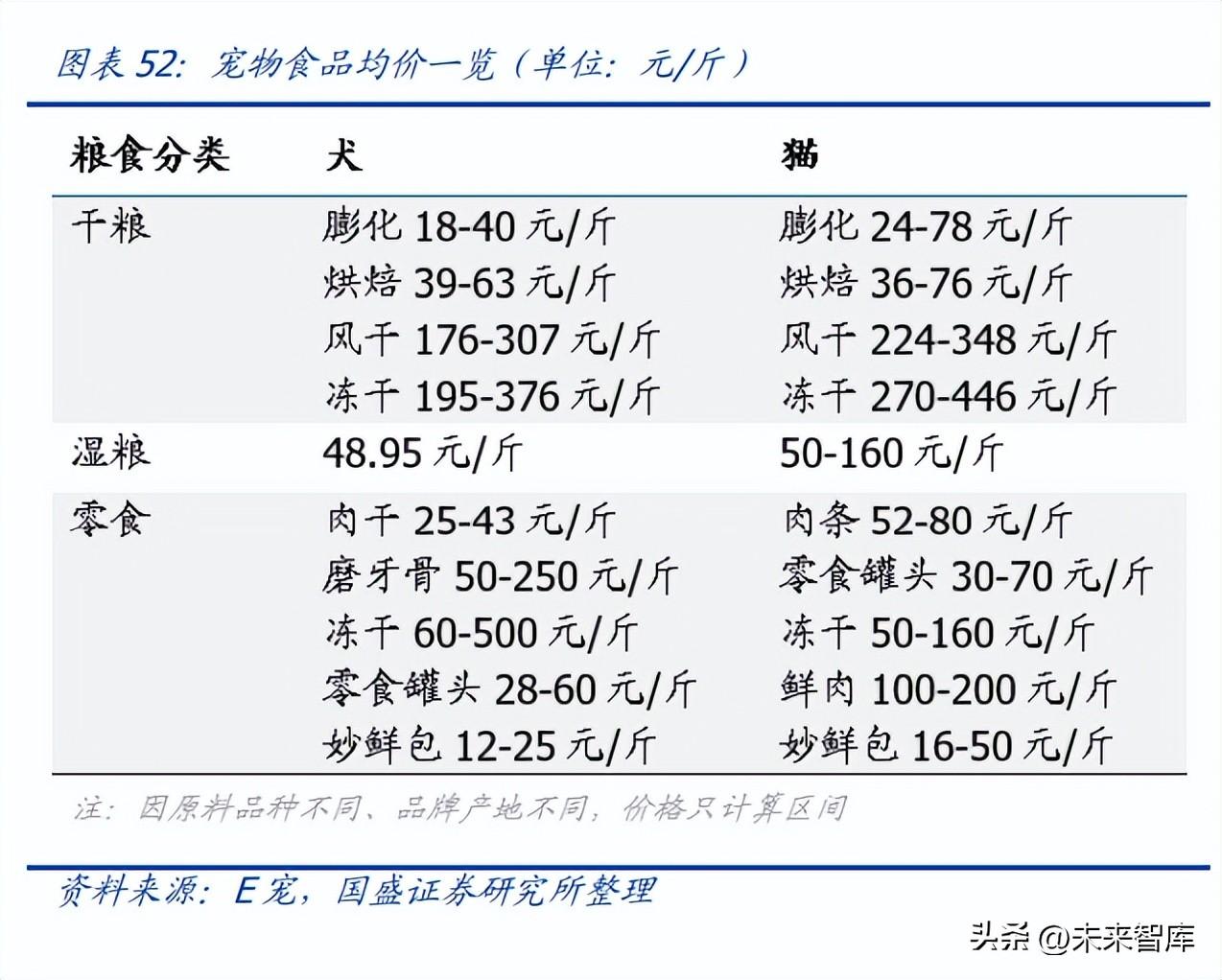

The top three staple food penetration rates for dogs are puffed food, baked food and freeze-dried food. Cats have a greater demand for wet food with sufficient water due to drinking habits. Therefore, the top three staple food penetration rates for cats are puffed food, frozen food. Dry food and wet food. In terms of snacks, among dog snacks, jerky and molar bones/jelly chews are in the first echelon, and canned and freeze-dried snacks are in the second echelon; among cat snacks, canned snacks, Miaoxian bags, and freeze-dried snacks form the first camp. Among them, freeze-drying is the category with the fastest increasing preference (from 2019 to 2021, dog owners’ preference for freeze-drying increased by 21.5%, and cat owners’ preference increased by 12.4%). The penetration rate of relatively expensive freeze-dried rations in the staple food and snack fields has increased significantly, reflecting pet owners' pursuit of high nutrition and high palatability.

"Gastrointestinal conditioning" is a common nutritional need for dogs and cats. Pet nutrition refers to minerals and vitamins fed in addition to staple food. Professional and high-quality rations on the market usually already contain the nutrients needed by pets. Nutritional products are mainly targeted at pets who have not taken pet food normally during their growth. Therefore, they are only used as supplementary rations. The market size is small, accounting for only 1% of pet food. 3.5% of the food market. According to the "white paper" data, among dog nutritional products, the preference for "calcium supplementation and bone strengthening" and "gastrointestinal conditioning" is significantly higher than other categories; cat nutritional product category preferences are concentrated in "hair removal products" and "gastrointestinal conditioning".

Quality and pet love are the main consumer decision-making factors. As mentioned earlier, the penetration rate of freeze-dried foods with good taste and high nutrition ranks high among staple foods and snacks for dogs and cats. This trend reflects pet owners’ pursuit of high nutrition and high palatability. The 2021 "White Paper" survey shows that among the decision-making factors for staple food consumption, "nutritional ratio", "ingredient composition" and "palatability" rank the top three; among the decision-making factors for snack consumption, the top three are "raw material ingredients", " "Value for money" and "Functionality"; similar to staple food and snacks, pet owners pay attention to reputation and functionality when choosing nutritional products, including "health function", "user reputation", "high cost performance", "good palatability", and "brand". "Famousness" respectively occupy the top five decision-making factors. Among the three types of subdivided foods, the consumer factors with the highest penetration rates are ration quality and pet love. Pet owners are less sensitive to price when it comes to staple food. In contrast, snacks and nutritional products are non-necessities, and their cost-effectiveness has a greater impact on consumption decisions. To be obvious.

The trust of domestic brands has increased. In the early stages of the development of the pet industry, most Chinese pet food companies were overseas brand OEMs. Foreign-funded enterprises represented by Mars and Nestlé Purina established scale, channel and brand advantages in the Chinese market before domestic brands. From the perspective of market concentration, the CR10 of my country's pet food industry reached 32.9% in 2020, and the market is relatively fragmented. Mars, a foreign-funded enterprise, remains the leader, occupying 10.5% of my country's market share. However, in recent years, with the expansion of the market size, more and more domestic brands have entered the market and have gained a certain market position by relying on their own channels, marketing and production technology and other late-mover advantages. Currently, 7 of the top 10 local companies in the pet food market have reached a certain level. Home. The trend of “domestic products” relies on the continued improvement of consumers’ trust in domestic brands. The "White Paper" report pointed out that among the top 10 most purchased brands of dog staple food in 2021, 60% are foreign brands and 40% are domestic brands. Among them, the Chinese brand Bernard Tianchun ranks first, with a usage rate of 22.5%; cats Among the top 10 brands in the category, local brands dominate in number, with 30% being foreign brands and 70% domestic brands.

2.4 Domestic pet medical market: low-frequency rigid demand and high growth, domestic leaders are ready to go

Pet medical care is the fastest growing market segment in the industry. According to the "White Paper" data, the scale of China's pet medical industry in 2021 is 72.708 billion, accounting for 29.2% of the pet industry market, with a growth rate of 89.07% within two years, making it the fastest growing market segment in the pet industry. Pet medical care is subdivided into two major sectors: hospitals (diagnosis, treatment and physical examinations) and animal health (medicines and vaccines). The pet hospital market size in 2021 is 43.834 billion, and the pet animal health market size is 28.884 billion. Compared with the mature U.S. market, China and the U.S. breed similar breeds of dogs and cats, and use similar brands for diagnosis, treatment, drugs, and vaccines (basically all are internationally renowned animal health brands), so the difference in required medical resources is small. However, there are currently 112 million dogs and cats in my country, and the number of dogs and cats in the United States in 2020 is 183 million (APPA data). The medical market size in 2021 will exceed US$34.3 billion (approximately RMB 246 billion). The number of pets in my country is about 2/3 of that in the United States, but the industry size is only 30% of that in the United States. Compared with markets in developed countries, China's pet medical market has huge potential.

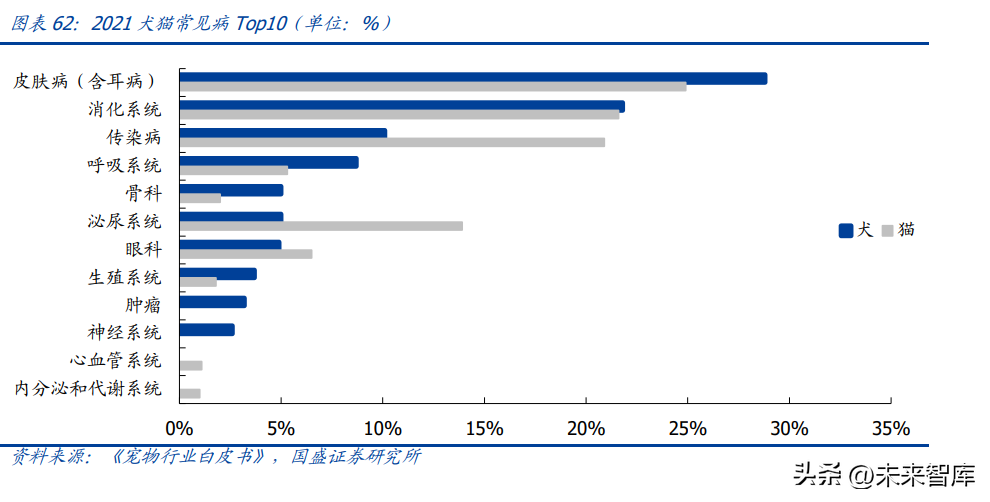

Skin diseases, digestive system diseases, and infectious diseases are the top three diseases that affect dogs and cats. As mentioned in the previous section on the US pet medical market, modern pets are susceptible to food-borne, psychiatric, or diseases caused by low immunity due to changes in diet and ecology. At present, the “three major killers” that harm the health of dogs and cats in my country are skin diseases (including ear diseases), digestive system diseases, and infectious diseases. Among them, 20.9% of cats suffer from infectious diseases, and 13.9% suffer from urinary system diseases. , about twice that of dogs. Dogs face more risks of respiratory diseases and tumor diseases, and malignant tumors have a 100% fatality rate.

2.4.1 Pet hospitals: high barriers, heavy investment, high stickiness, accelerated integration of chain hospitals

Customer demand is highly sticky. The pet hospital market size in 2021 is 43.844 billion, accounting for 60.27% of pet medical care, a year-on-year increase of 31%. Among them, the scale of diagnosis and treatment is 36.354 billion, and the scale of the physical examination market is 7.47 billion. According to the "white paper" data, pet hospitals have high customer stickiness. Among the channels through which pet owners can learn disease information, 75.6% of pet owners choose "consult a doctor", 65.2% choose "go directly to the hospital for treatment", and 33.6% Pet owners “fully follow” veterinarian-recommended disease nutrition plans. At the same time, in addition to diagnosis and treatment and physical examination services, pet hospitals also sell pet products and services. They are the top three purchase channels for pet food, supplies, grooming and care, and their usage rate exceeds pet stores and supermarkets. 66.3% of pet owners surveyed said they had purchased goods or services from pet hospitals. The pet hospital has become an offline comprehensive service platform, reaching more people with a richer product ecology, integrating pet life needs into medical needs, increasing the stickiness and activity of original customers, thus forming feedback on the repurchase rate of the pet hospital's own services. Single hospitals are still the mainstream of pet hospitals, and chaining is in its initial growth stage. According to data from the "2021 Pet Medical Industry White Paper" (hereinafter referred to as the "Medical White Paper") jointly compiled by AiPet, the Chinese Veterinary Medical Association, etc., currently my country's single hospitals (1) account for 41.4%, and chain hospitals (5 or more) account for 41.4%. Compared with 20.1%, independent hospitals still constitute the mainstream of the pet medical treatment institution market. my country's pet medical industry is in the preliminary development stage. The 2021 pet hospital revenue data shows that 10.3% of hospitals are still in a state of loss. In the short term, our country's market is temporarily insufficient to fully support the development of large-scale direct-operated chain pet medical institutions. However, in the long run, independent hospitals face difficulties such as difficulty in attracting customers, weak funds, and uneven doctor levels. They are relatively weak in factors such as doctor professionalism, reasonable pricing, and advanced equipment that pet owners are most concerned about. In the future, chain pet hospitals will become mainstream. The current number of chain hospitals has increased by 4 percentage points compared with 2020, and the top ten hospitals with the highest usage rates among pet owners are all chain hospitals. It is expected that in the future, the advancement of the standardization of pet medical policies in my country will rectify the price chaos in the industry. The current cooperation between chain hospitals, pharmaceutical companies, and pet insurance companies will alleviate consumer price pressure to a certain extent, directly address the pain points of pet medical consumption, and help chain hospitals form a scale. effect.

Medical services are refined, from general practitioners to specialists. In the past, most pet hospitals did not set up sub-specialties due to their small scale and few staff. Pets were usually treated by unit doctors for general diagnosis regardless of type. In recent years, as the number of pets continues to grow and the "anthropomorphic" characteristics of pets have become more prominent, there has been a need to establish specialized departments for different pet types and diseases, similar to human hospitals. The "White Paper" 2020 pet medical special survey report shows that when choosing a hospital, about 14.5% of pet owners prefer specialized hospitals that separate cats and dogs, and 10.6% of pet owners prefer specialized hospitals. Specialty departments include geriatric diseases, surgery, ophthalmology, dermatology, dentistry, feline medicine, etc.

Digitalization empowers industry development. The number of pet hospitals that combine specific industries with digitalization continues to grow. The "Medical White Paper" shows that the vast majority of hospitals have shifted from traditional media and offline promotion to online channel marketing based on self-media and e-commerce platforms; in the ranking of new customer source channels for hospitals, online promotion channels rank first , reaching 64.8%, which marks that the pet medical industry has followed the development trend and entered the digital era. In addition to marketing methods, pet owners’ urgent demand for online consultations will also continue to support the digitalization of pet medical care. Due to the prominent "anthropomorphic" characteristics of pets, pet owners tend to keep track of their pets' health trends and get timely feedback from professionals. 53.86% of pet owners prefer online consultation or online consultation before offline medical treatment; in Among the services provided by Hope Hospital, the proportion of people who choose "online consultation services" exceeds 1/3 (the data comes from the "white paper"), indicating that the demand for pet owners to choose pet medical treatment scenarios is gradually extending to online.

2.4.2 Pet animal health: “It economy” stirs up the situation and is expected to leverage the blue ocean of over 10 billion domestic brands

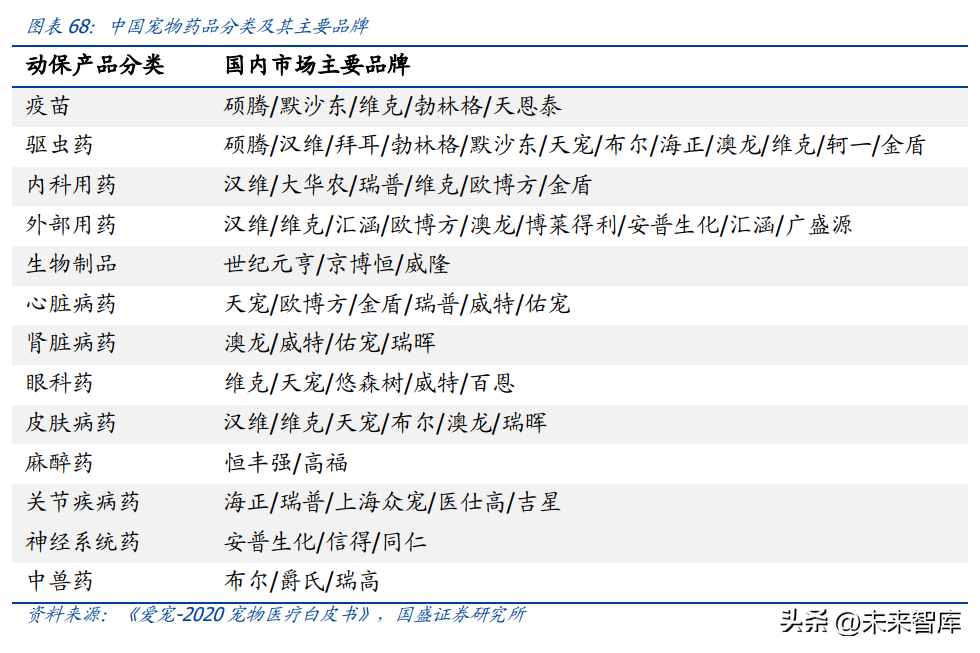

Imported brands still occupy the main market, and the domestic substitution space exceeds 10 billion. According to the "White Paper" data, China's pet animal health market will reach 28.884 billion in 2021, accounting for 39.73% of the entire pet medical market, a year-on-year increase of 45.7%. Among them, pharmaceutical sales were 22.41 billion and vaccine sales were 6.474 billion. The current competition pattern of my country's pet animal health market is similar to that of the global pet animal health market. International leaders occupy the main market. The top ten sales are basically well-known companies such as Zoetis, Boehringer Ingelheim, and Lilan. Pet clinical practice has long relied on imported brands. Pet data shows that in 2020, imported manufacturers accounted for nearly 70% of my country's pet animal health market, and domestic brands Hisun, Rip, and Golden Shield accounted for less than 1/3. Calculated based on the industry scale of 19.824 billion in 2020, conservative It is estimated that the import substitution space exceeds 10 billion.

The size of the pet animal health market is expected to gradually exceed that of the livestock and poultry animal health market. According to the experience of developed countries represented by the United States, my country’s pet animal health market is also expected to surpass economic animals. Take the data of Zoetis, the world's leading animal health company, as an example. Within its global business, there are eight countries/regions where the proportion of pet animal health business exceeds the proportion of livestock and poultry animal health revenue, including China. Since 2019, Zoetis's pet business in China has exceeded the livestock and poultry animal health business for the first time. In the seven years from 2014 to 2021, the proportion of pet animal health products in China's business has increased from 16% to 53%. Compared with the profit scale of China's pet sector of US$17 million in 2014, the scale has grown to US$189 million in 2021, with a seven-year CAGR of 40.93%.

Vaccination habits still need to be developed, and it is expected that there is still considerable room for improvement in product penetration. "White Paper" data shows that about 60% of pet owners in my country regularly vaccinate their pets every year. According to the type of disease, pet vaccines are generally divided into infectious disease vaccines (including canine distemper, canine parvovirus, hepatitis and other vaccines) and rabies vaccines. The mortality rate of rabies reaches 100%. Once the disease occurs, there is currently no effective treatment plan. Vaccine prevention can be the main approach. At present, only 67% of pet owners in my country are regularly vaccinated against rabies, and 74% are vaccinated against infectious diseases; 12% of pet owners have not vaccinated their pets against rabies, and 4% have not been vaccinated against infectious diseases. Overall, there is still much room for improvement in vaccination penetration, supporting the continued expansion of the pet vaccine market. Deworming medicine has strong in-demand properties and is the largest single product for pet animal protection. In recent years, as the number of pets in China continues to grow, pet drug consumption continues to grow. Anthelmintic drugs are one of the necessary drugs for raising pets. Referring to the United States, where the pet industry is highly developed, pet anthelmintic drugs account for more than 50% of the pet drug market share. The size of my country's pet drug market in 2021 is 4.72 billion yuan. Data from the "2021 China Pet Medical White Paper" show that in the pet hospital animal health product sales segment, anthelmintic drug sales account for approximately 25.1%. In addition to pet hospital sales channels, The sales performance of pet anthelmintics remains impressive. In the TOP10 list of pet drug flagship stores on Taobao e-commerce platform, 8 brands including Fulian, Pointe, Dr. Witte, and Da Chong Ai all sell pet repellents. However, the current mainstream products are still mainly imported and domestically produced. The alternative prospects are promising.

The research and development of pet products by domestic animal health companies is accelerating, and the leading companies are expected to seize the opportunity. Judging from the clinical approval data of crude drugs for cats and dogs in the past three years, the research and development of pet products by domestic animal health companies has significantly accelerated. Many domestic companies have been approved for clinical trials of large single products such as cat triplex and dog quadruple, including Rip Biotech, General Pharmaceuticals, etc. Listed companies such as Lyco and many other companies are preparing to apply for clinical trials. In addition, domestic animal health companies have emerged in the field of pet drugs: Hisun Pharmaceuticals currently ranks as the number one brand of pet drugs. The sales of large-scale single product Hailemiao (anthelmintic drug) exceeded 100 million in 2021, and the new product Mo Aijia (anthelmintic drug) sales quickly exceeded 10 million; Rip Biotech launched Mopusin (anthelmintic drug) in July 2022. Since its launch in July, the single-month sales of Mopusin have reached tens of millions. In the future, annual sales are also expected to reach the level of 100 million yuan.

3 Analysis of key companies

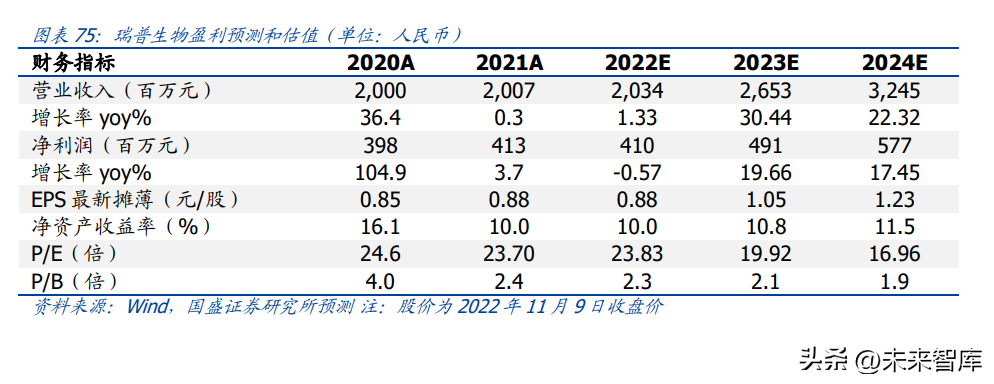

3.1 Rip Bio: a leading company in poultry animal health, making efforts in multiple fields such as pets

A leader in the animal health industry and a leading player in the poultry products industry. Rip Biotechnology was established in 1998. It has 19 holding subsidiaries, 10 veterinary drug GMP production bases, 83 production lines, and more than 500 kinds of livestock, poultry and other animal products. It is a four-in-one animal health product manufacturer that integrates biological vaccines, pharmaceutical raw materials, pharmaceutical preparations, and feed additives. China's leading manufacturer and service provider. In 2021/2022Q1~Q3, the company achieved revenue of 2.007/1.477 billion yuan, respectively, +0.34%/-1.48% year-on-year, and net profit attributable to the parent company of 413/233 million yuan, +3.66%/-20.25% year-on-year, respectively. Poultry products lead the market, and pig products are expected to return to the growth track. 1) The company started with poultry medicine products, and also gave priority to poultry products. In 2015, it acquired South China Biotech and entered the field of highly pathogenic avian influenza, the largest single product of poultry. In recent years, poultry products have continued to be upgraded and iterated, and the group has The expanded customer coverage of the farm jointly supports the steady growth of the poultry sector, while the profitability of poultry products remains high in the industry (gross profit margin is around 60%). 2) Porcine products are greatly affected by cyclical fluctuations. The company continues to try new product breakthroughs. New products such as the 2022H1 porcine circovirus type 2 subunit vaccine have obtained product approval. New product iterations and the improvement of the downstream pig boom are expected to promote the sales of piglets. Get back on the growth track.

The layout of pet products leads the industry and the channel differentiation advantage is significant. The company's original pet products cover anesthesia, dermatology, anti-inflammation and other fields, and some products have leading domestic market shares. In July 2022, the new anthelmintic drug Mopusin was launched. The anthelmintic drug is the largest single product in the field of pet drugs. Mopusin has achieved good sales progress since its launch. Compared with Zhejiang Hisun Animal Health, the company has driven The annual sales of single insect drug products are expected to exceed one trillion yuan in the future. The pet vaccine product layout is also relatively advanced, with key products such as “cat triple” and “dog quadruple” having entered the clinical stage. In addition, on the pet product channel side, the company has established in-depth strategic cooperation relationships with joint-stock companies Yichong Technology and Ruipai Pet Hospital in supply chain, channel integration, digital informatization, pet medical care, etc., and the omni-channel collaboration creates differentiated advantages. , laying the foundation for mid- to long-term growth of the pet business.

3.2 Huisheng Biology: Dilemma reversal, highly elastic target, layout of new pet market

As a leader in veterinary chemicals, it has a rich range of chemical products and has fully benefited from the ban on antibiotics in feed. In the mid-term, pig prices support strong demand growth. Huisheng Biotechnology was established in 2002 and is mainly engaged in the research and development, production and sales of veterinary drugs, feeds and additives. As of the end of June 2022, 142 veterinary drug approval numbers have been obtained. The sales scale ranks among the top 10 domestic enterprises in the field of veterinary chemical preparations in terms of annual sales. In 2020 and 2021H1, fully benefiting from the ban on antibiotics in feed, the revenue scale increased significantly by 81.98% and 86.78% respectively year-on-year, significantly accelerating. In 2021, it achieved revenue of 996 million yuan (yoy +28.14%) and net profit attributable to the parent company of 133 million yuan (yoy -11.52%). The decline in performance from 2021H2 to 2022H1 was mainly due to the sharp increase in the price of upstream APIs in the second half of the year and the demand from the downstream breeding industry. Weakness suppresses. Since June 2022, pig prices have remained relatively high, and the recovery in demand for the company's products has pushed revenue back to the track of growth. In 2022Q3, it achieved a single-quarter revenue of 275 million yuan, a year-on-year increase of 30.59%, and a net profit attributable to the parent company of 19.8933 million yuan, a year-on-year increase of 8.11%. %. As the utilization rate of new production capacity increases and the proportion of high-end products increases, the performance recovery flexibility will be considerable. Since mid-April, the boom in pig breeding has driven a significant recovery in demand for animal health, and the demand for chemicals has recovered with considerable elasticity. It has excellent research and development capabilities, continues to launch new products, and develops efforts in many fields such as pets. Through vigorous investment in research and development, the company continues to expand its products and improve production capacity and quality and efficiency, and its ability to innovate comprehensive veterinary drug solutions continues to increase. In 2022, Taidirosin injection (mainly used for piglet health care) will be launched, with good sales. The remaining products are also well-stocked, and are gradually expanding from pig use to poultry, aquatic products, pets, ruminant and other fields. The company has established a pet branch and established a dedicated R&D and sales team. Currently, there are more than 20 pet drug projects under development. The pet product layout mainly focuses on deworming and anti-inflammatory products. In the first half of 2022, there are 11 pet health care products for cats and dogs. products and 2 pet drugs have been launched successively. In addition, process research and development has promoted the company's continuous improvement of production technology. In 2022H1, the fermentation potency and average batch output of tivalisin API increased by 4.5% and 6.7% respectively compared with 2021, and production efficiency was improved.

Direct sales and distribution are "flying together", and the proportion of group customers has increased. In line with the large-scale development trend of the downstream breeding industry, the company has established a group customer sales department to provide customized services to large-scale customers from multiple perspectives. At the same time, it also uses distribution channels to meet the needs of small and medium-sized retail investors. The number and penetration rate of large-scale customers have steadily increased. In 2020/2021, the company's group customers achieved sales revenue of 430 million yuan/610 million yuan, a rapid growth of 112.68%/41.03% respectively year-on-year. The revenue proportion of group customers increased to 60%+. As the scale of the downstream breeding end continues to increase, the company Expect to benefit fully. The release of new production capacity has combined with the standardized development of the industry, and the leading position remains stable. The trend of industry standardization management is clear. The ban on antibiotics in feed and the implementation of the new version of GMP in 2020 will promote the growth in demand for therapeutic chemicals and increase industry concentration, which will benefit the sustainable growth of industry leaders in the medium and long term; the company has steadily extended from preparations to upstream APIs, and now There are 240 tons of tiversin production capacity and 1,000 tons of tylosin (IPO project). In addition, the construction of 600 tons of convertible bonds and 1,000 tons of tylosin projects is still progressing steadily, and macrolide products are on the rise. The basic layout of the downstream is completed. The gradual release of API production capacity is expected to fully guarantee product quality and supply, and cost control capabilities are also expected to improve.

3.3 Keqian Biotech: the leader in non-forced immunization veterinary vaccines, with outstanding advantages in R&D, products and channels