The pet industry has great resilience, and Chinese enterprises are worth looking forward to

According to the American Pet Products Association (APPA), the total sales of the US pet market industry in 2022 exceeded $136.8 billion, a year-on-year increase of 10.8%. Among them, pet food and snack sales: the category with the highest expenditure in 2022, with a total amount of 58.1 billion US dollars, accounting for 42.5% of the industry's total sales, a year-on-year increase of 16.2%. Showing strong consumption capacity and development resilience. Looking back at the past decade, the size of the US pet industry has increased from $53.33 billion in 2012 to $123.6 billion in 2021, with a GAGR of 8.8%. Even during the 2008 financial crisis, the size increased by 4.9% year-on-year, showing a clear anti cyclical characteristic.

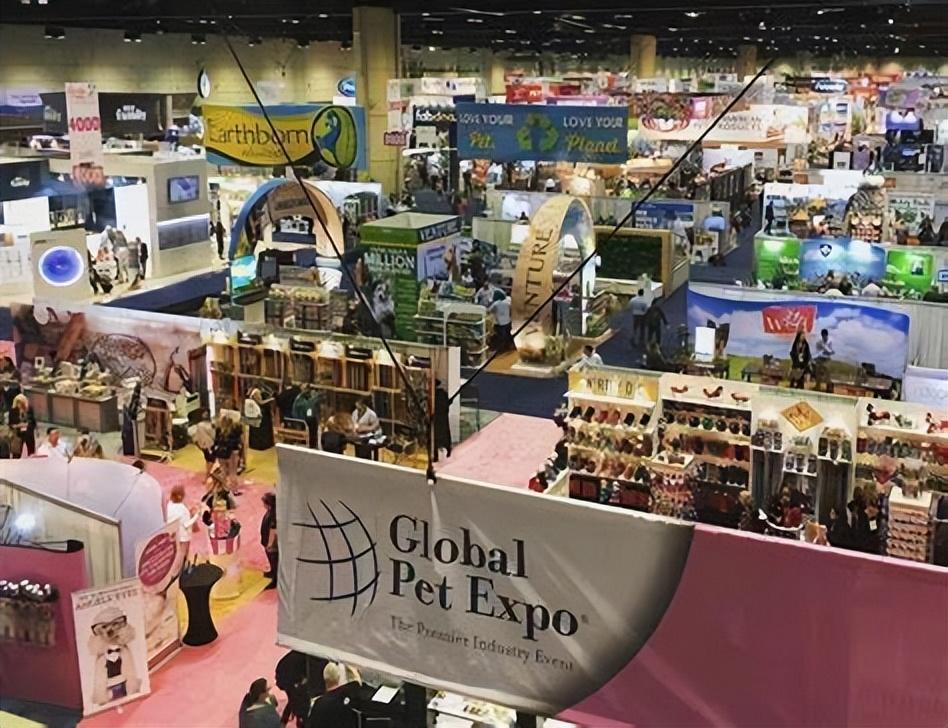

From March 22 to 24, 2023, the Orlando Pet Show, jointly organized by the Pet Association of America (APPA) and the Pet Distributors Association (PIDA), was held in Orlando, attracting numerous companies from around the world to participate. It is reported that this is one of the largest pet fairs in the world and the first overseas exhibition of the pet industry in 2023. It is worth mentioning that more than 1000 companies participated in the exhibition this year, an increase of 50% compared to 722 last year. One of the main markets is the United States, which is a major pet food market in the world. All business entities have long been optimistic about the future growth of the US market; Secondly, in terms of participating products, the number of new product exhibitions has broken the official record of previous years, and even reached a new height in the global pet exhibition industry.

According to research by Debang Securities, benefiting from the steady growth of the overseas pet market and the continuous improvement of research and manufacturing capabilities of China's pet OEM enterprises, China's pet food exports have maintained a rapid growth trend, with a compound annual growth rate of 10% from 2017 to 2022. The main export regions are the United States and European markets, with pet food in the United States accounting for 40% of the pet industry and Europe accounting for 54%.

The overseas market has provided us with an important inspiration that pet consumption is resilient. More importantly, in recent years, while the Chinese market has been experiencing high compound growth rates, the quality of growth has been continuously improving, and the upgrading of pet consumption has become the second engine for the development of the pet industry. Chinese pet companies are no longer satisfied with working for overseas brands and are more adept at satisfying the appetite of Chinese consumers. The market share of domestic brands is constantly expanding. Some analysts believe that as market competition becomes increasingly fierce, the key to the success or failure of Chinese enterprises in the future lies in whether they can provide differentiated (high-quality) products and multi brand operational capabilities.

Tang Zhaobo, Secretary of the Board of Directors of Petit Corporation, also stated that Petit Corporation's global layout has been implemented for many years. Overseas factories can not only export snack products, but New Zealand factories will also provide high-end staple food products to the global market. The company's advantages in diversified product supply, multi brand matrix, and multi country manufacturing will become more significant in the future.