Where is the turning point? Feed costs remain high, and dairy farming is under pressure

The pressure from feed costs has once again brought attention to the raw milk industry. Since 2021, domestic feed prices have been continuously rising, and this year, the rise in prices of soybean meal, corn, and other products has further increased the breeding costs of upstream pastures. Even the occurrence of harvesting green wheat for feed, although on a small scale, reflects to some extent the problems in the breeding sector.

In the face of feed shortages and high prices, how animal husbandry companies respond and when the continuously rising prices can be alleviated are all topics of considerable concern in the industry.

Is there a shortage of feed?

Not long ago, multiple videos of harvesting green wheat for ensiling feed became popular, attracting attention from both inside and outside the industry. According to a survey conducted by the China Dairy Industry Association, it was found that wheat was used as silage feed in a few dairy farms in the Yellow, Huai, and Hai regions. The main problem was that there was a certain gap in silage corn, especially due to the severe autumn flood in the north last year, which resulted in insufficient harvesting and storage of silage corn. As a result, the shortage of silage feed increased, and wheat silage could only be used temporarily for emergency response. Most of them are farms that rotate and crop wheat on the supporting forage land. But there are also individual farms that have locally stored some wheat, but not on a large scale or in a small area. And the situation quickly subsided. Both the Ministry of Agriculture and Rural Affairs and the Henan Provincial Department of Agriculture and Rural Affairs issued notices requiring that wheat silage should not be carried out and investigating such situations.

It is understood that since September 2021, several provinces in the north have experienced continuous heavy rainfall, and many silage corn fields have experienced flooding, which has caused large-scale harvesting machinery to be unable to operate on the ground. The continuous rainfall has also forced the harvesting time of silage fields to be delayed, not only affecting the quality and yield of silage corn, but also leading to insufficient feed reserves for some farmers.

According to the information from the Agricultural Information Research Institute of the Chinese Academy of Agricultural Sciences based on the Agricultural and Rural Information Quick Tune Platform at that time, a targeted survey was conducted on 472 silage farmers (pastures) from provinces such as Henan, Hebei, Shandong, and Inner Mongolia. The investigation found that nearly 80% of farmers delayed the harvesting of silage corn by 7 days or more, with the longest harvesting time delayed by 55 days and an average delay of 12.1 days. Floods caused by excessive rainfall in the early stage were the main reason for the delay in silage corn harvesting.

Feed pressure leading to a decrease in profits

Feed cost pressure is a common problem faced by upstream aquaculture ends. Due to the increase in feed costs, the gross profit of upstream enterprises has been squeezed, and some small and medium-sized breeding scenes are facing a situation where they cannot make ends meet.

In the 2021 financial report, Modern Animal Husbandry mentioned that the cost of kilogram milk feed was 2.67 yuan, an increase of 0.38 yuan year-on-year. Among them, the direct feed cost of kilogram milk was 2.11 yuan, an increase of 0.34 yuan year-on-year.

The 2021 financial report of China Shengmu also showed that the cost of kilogram of milk feed was 2.6 yuan, a year-on-year increase of 23.2%, resulting in a decrease in gross profit margin.

On May 26th, when answering investors' questions, the farm pointed out that since 2021, domestic feed costs have significantly increased, such as the increase in coarse feed required for dairy farming (such as silage, alfalfa, oat grass). Since 2022, the prices of soybean meal, corn, cottonseed, etc. have continued to rise.

At the performance conference of Modern Animal Husbandry held in March, CFO Zhu Xiaohui of Modern Animal Husbandry stated in response to investors' questions that the current feed cost has significantly increased both compared to the same period in history and in terms of cost proportion.

For small and medium-sized ranches, despite the rising feed costs, milk prices have not risen, and there is even a faint downward trend, with some ranches already experiencing losses. The person in charge of Shandong Yimu Industry Company stated that since February, the milk price has been between 3.6 to 4.1 yuan, and in March, the milk price is still declining. This year, most of the raw materials were purchased at a high level, resulting in breeding costs reaching around 4.3 yuan.

Whether it is a large animal husbandry company, a thousand head ranch, or a small to medium-sized ranch, they have been facing pressure from feed costs since 2021.

How to respond?

The continuously rising feed costs have brought pressure to the upstream breeding end, but companies are also alleviating it through various means. For example, modern animal husbandry has moderately suppressed the impact of rising feed costs by improving the health of cattle, optimizing feed formulas, and utilizing unified procurement platforms.

China Shengmu imports feed products through a supply chain center established in Tianjin, reducing intermediate procurement costs, and implementing a "milk meat linkage" to improve its profit structure through organic and DHA dairy farms.

Manor ranches alleviate the pressure of rising costs by strengthening ranch management efficiency, improving yield per unit area, and optimizing herd structure.

In addition, in addition to reducing costs and increasing efficiency, some enterprises also solve this problem by investing in upstream feed enterprises. Modern Animal Husbandry has laid out its feed business and established a joint venture with COFCO Feed to establish Modern Feed (Tianjin) Co., Ltd., aiming to achieve the goal of closing the integrated industrial chain of "animal husbandry, feed and milk". However, modern animal husbandry originally had feed business, but it accounted for a relatively small proportion. According to its 2021 annual report, the sales amount of feed was only 73 million yuan, accounting for 1%.

In October 2021, China Shengmu plans to jointly invest 100 million yuan through subsidiaries and modern animal husbandry companies to build a feed processing base with an annual production capacity of one million tons in the Bonded Logistics Park of Mudanjiang Economic and Technological Development Zone, namely the Sino Russian Cross border Agricultural Industry Million ton Russian Grain Processing Project, which can meet the company's feed demand and reduce feed costs.

In addition to corporate actions, some main production areas of feed ingredients are also encouraging increased planting to cope with market changes. For example, Heilongjiang is a high-quality soybean production and supply base in China, with a perennial soybean planting area accounting for over 40% of the country and a commodity rate of over 80%. This year, Heilongjiang Province has made adding 10 million acres of soybeans an important task, and the province aims to achieve a soybean planting area of 68.5 million acres this year to reduce external dependence.

Continuously Rising Feed Prices

It is understood that feed costs account for about 70% of the cost of dairy farming, and soybean meal is an important source of protein feed in dairy feed. The continuous rise in the prices of soybean meal and corn has driven up the cost of milk production. Although the price of soybean meal has decreased recently, it is still much higher than the same period in previous years.

According to the price situation of livestock products and feed markets in the second week of May 2022 announced by the Ministry of Agriculture and Rural Affairs of the People's Republic of China, the average price of corn nationwide was 2.97 yuan/kg, an increase of 0.3% from the previous week and unchanged year-on-year; The average price of soybean meal nationwide is 4.54 yuan/kg, a decrease of 1.5% from the previous week and a year-on-year increase of 22.0%.

1. Soybean meal prices are still higher than in previous years

According to the data research department of Huitong, a feed industry information website, the average price of soybean meal in April 2022 was 4477.79 yuan/ton, a decrease of 8.92% compared to the previous month.

According to Mysteel's agricultural product data, in 2022, the market price of soybean meal rose and fell, but the price center significantly shifted upward. Most of the time, the national average price of 43% soybean meal was above 4000 yuan/ton. As of June 1st, the average price of 43% soybean meal nationwide was 4264 yuan/ton, a year-on-year increase of 676 yuan/ton or 18.84%.

The price of soybean meal has decreased from the highest of over 5000 yuan per ton to over 4000 yuan per ton now, which has reduced the cost pressure on farms. However, it is not difficult to see from the chart below that the price of soybean meal is still significantly higher this year than in previous years.

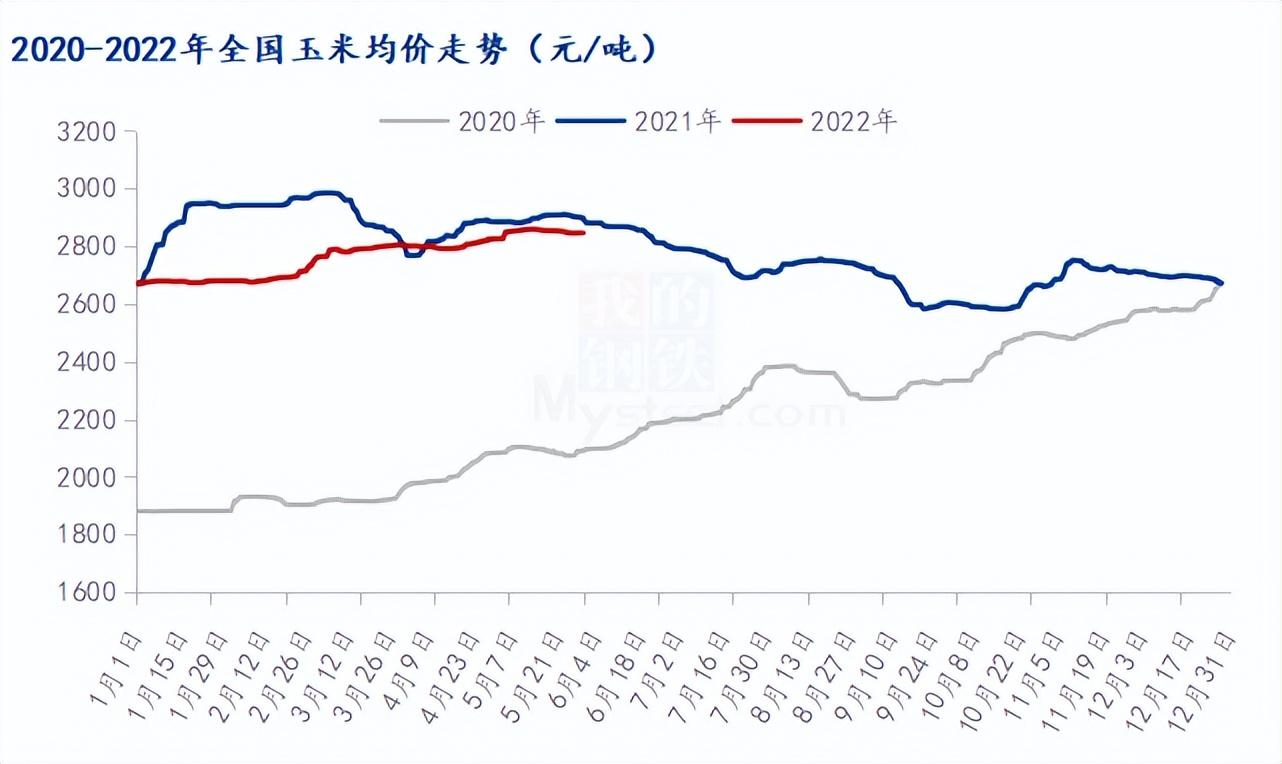

2. Corn prices are also at a high level

Since 2020, domestic corn prices have risen by over 50%, reaching around 2600 yuan/ton in December 2021. According to Mysteel's agricultural product data, in 2022, the corn market price continued to operate at a high and slightly stronger level, with frequent price fluctuations but not significant changes. As of the end of May, the market price of corn in China was 2845 yuan/ton, a decrease of 1.56% compared to the same period last year.

3. The prices of alfalfa and oat grass have both increased year-on-year

Since 2021, the price of alfalfa has increased by 30%. Currently, the landed price of imported alfalfa has exceeded 450 US dollars per ton, and the price of oat grass is also increasing.

According to customs statistics, from January to April 2022, China imported a total of 531600 tons of alfalfa hay, a year-on-year increase of 27.4%, with an average CIF price of 449.50 US dollars per ton, a year-on-year increase of 26.2%.

From January to April, imported oat hay reached a total of 49400 tons, a year-on-year decrease of 56.2%, with an average CIF price of 401.62 US dollars per ton, a year-on-year increase of 22.9%.

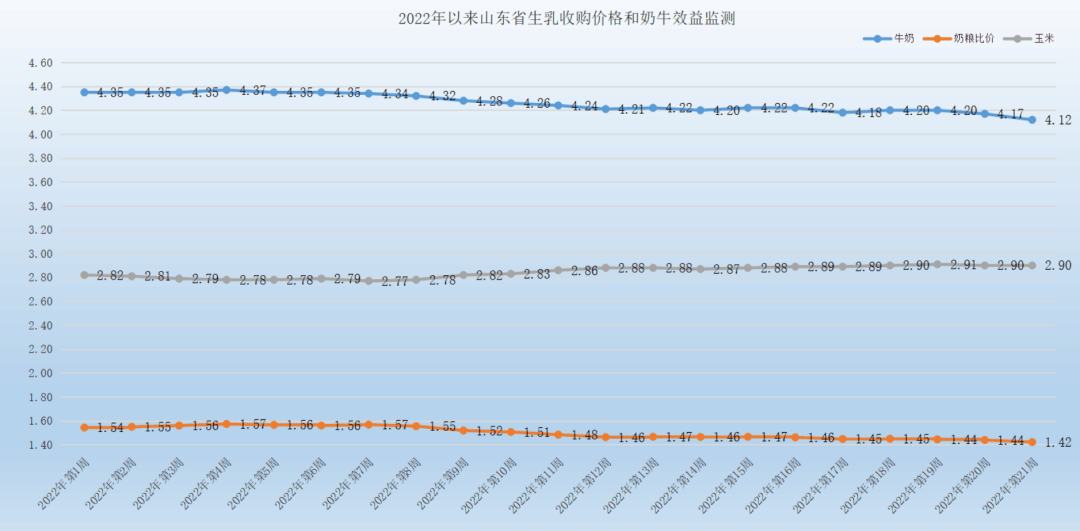

4. The benefits of dairy farming continue to decline

As the cost of farming increases, the benefits of dairy farming also begin to decrease. As one of the major provinces in the dairy industry, Shandong Province has certain representativeness. According to the analysis of the market situation of livestock products in Shandong Province released by the Shandong Provincial Animal Husbandry and Veterinary Bureau from May 23rd to May 29th, as of the end of the 21st week, the raw milk in our province was 4.12 yuan/kg, a year-on-year decrease of 3.96% and a month on month decrease of 1.20%. Among the 26 counties monitored, after excluding invalid data, the highest price was 4.76 yuan/kg and the lowest price was 3.60 yuan/kg.

Affected by the low milk prices, the efficiency of dairy farming continues to be low. This week's milk grain ratio was 1.42:1, a year-on-year decrease of 2.69% and a month on month decrease of 1.20%. As of the end of May, the daily feeding cost of dairy cows (based on an average daily yield of 30 kilograms per cow), equivalent to an average cost of 3.90 yuan per kilogram of milk.

Where is the turning point?

At an online seminar held in early 2022, Li Shengli, the Chief Scientist of the National Dairy Industry Technology System, proposed that the feed prices of China's dairy industry will still be high in 2022, and the prices of silage and long hay roughage will increase by 15% -20%, which will drive the cost of cow roughage to increase, from 33% of the total cost in 2021 to 38% in 2022.

So, what is the price trend of soybean meal and corn this year? When is the expected turning point?

At present, the domestic spot supply of soybean meal is in a relatively loose period, which has led to an overall downward trend in the spot price of soybean meal in the past two months. The main reason is that from April to May, the domestic import of soybeans to Hong Kong gradually rebounded, and the supply of soybeans in oil factories was sufficient, ensuring the operating rate. As a result, the output of soybean meal increased significantly, leading to a continuous increase in soybean meal inventory. Due to the lower demand for soybean meal in downstream feed compared to the supply of soybean meal, and the high price of soybean meal, which to some extent inhibits the consumption capacity of terminal breeding soybean meal, soybean meal inventory is still likely to further increase in the future, and soybean meal will have a phased bottom at that time.

As for the trend of corn, the grassroots grain sources in the production areas are basically exhausted, and corn is concentrated in the circulation environment. Deep processing enterprises and feed enterprises maintain relatively high inventory and control the procurement pace in the near future. In the long run, the main factor affecting the price trend of the corn market remains supply and demand. It is expected that an important turning point in the corn market will occur at the end of September when the new season corn is concentrated for listing. Before the centralized listing of new corn, there was no significant change in supply and demand, and prices continued to operate at high levels.

The above analysts believe that domestic feed companies have experienced multiple rounds of price increases since 2022, mainly due to a significant increase in raw material prices compared to the previous year. The prices of main raw materials such as corn and soybean meal in feed raw materials do not have a significant decline foundation in the short term. The solution to high prices in feed enterprises may be within the enterprise. In this context, increasing research and development efforts, such as low protein diets, further scientific refinement of animal nutrition, or a better choice to solve high feed prices.

In the short term, the prices of feed such as soybean meal and corn are still relatively high, and cost pressure will continue to affect the breeding end. Large animal husbandry companies can still alleviate some of the pressure through supply chain advantages and can still support it. However, some small and medium-sized ranches are facing greater pressure, and even have experienced losses. In the previous round of the dairy industry cycle, many small and medium-sized farms have already withdrawn. It is worth paying attention to whether this will further promote large and medium-sized farms to become the mainstream breeding method.