In August, the national feed output increased slightly, and the ruminant feed increased significantly

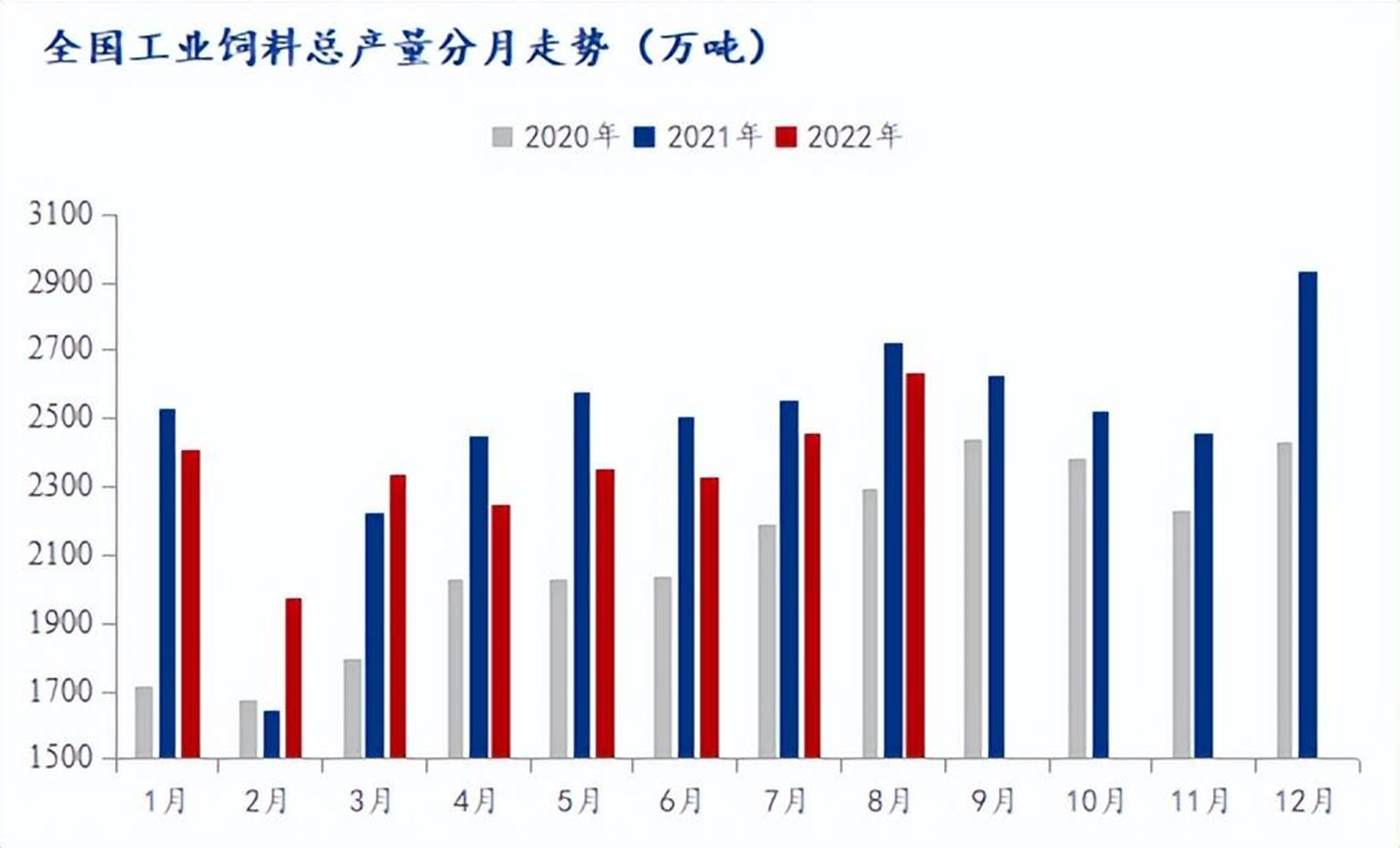

According to the statistics of China Feed Industry Association, the national industrial feed output in August 2022 will be 26.35 million tons, an increase of 7.2% month on month and a decrease of 6.7% year on year. In terms of variety, the pig feed output was 10.67 million tons, up 8.5% month on month and down 11.2% year on year; The output of egg and poultry feed was 2.53 million tons, up 3.2% month on month and down 9.9% year on year; The output of meat and poultry feed was 7.89 million tons, up 6.2% month on month and down 4.8% year on year; The output of aquatic feed was 3.69 million tons, up 7.2% month on month and 3.0% year on year; The output of ruminant feed was 1.29 million tons, up 11.1% month on month and 4.7% year on year.

In August, as the weather became cooler, the terminal livestock and poultry intake increased. With the Mid Autumn Festival and the approaching school opening, the terminal market demand improved. In terms of pig feed, it continued to increase slightly in August compared with July, mainly because the pig price in August continued to maintain a strong shock operation, and the downstream breeding profits were still abundant. The increase in pig feed was significant due to the impact of the Mid Autumn Festival and the school opening season on pork consumption.

In terms of poultry, in August, egg and poultry feed stopped falling and recovered. After the nationwide weather ended the summer high temperature, egg and poultry breeding and restocking stage were ushered in; In addition, with the approaching of the Mid Autumn Festival and the school season, the demand for goods in all links has increased, and the demand for goods has been active. The market has been brisk in both purchase and sales, which has driven the price of eggs to rise continuously, and egg and poultry feed has increased by 3.2% month on month. In terms of meat and poultry, the feed increased steadily in August. With the increase of supplement in the early stage, the supply of meat and poultry was sufficient. In addition, the current breeding profit was still considerable, although narrowed, making the meat and poultry feed still maintain a stable increase of about 6% month on month compared with July.

In terms of aquatic products, as the weather turns cooler, aquatic feed, although still growing, has declined significantly compared with July. In terms of rumination, as the weather turns cooler, the consumption demand of beef and mutton will improve and the price will also rise, boosting the output of ruminant feed at the terminal, with a sharp increase of 11.1% in August.

In terms of feed product prices, in August 2022, the ex factory prices of main formulated feed, concentrated feed and additive premix feed products will increase mainly on a month on month basis. As the price of main raw materials remained at a high level compared with the same period last year, the factory prices of formulated feed and concentrated feed products continued to increase year on year. Take soybean meal as an example. According to the statistics of Mysteel agricultural products, the soybean meal futures price rose in August in a volatile manner. As of August 31, the M2301 contract, the main continuous meal contract, closed at 3789 yuan/ton, up 109 yuan/ton from July, or 2.96%.

The spot price of soybean meal in August was low when the soybean meal of the oil factory entered the destocking stage, and the downstream breeding demand improved after the autumn, as well as the expected decrease of domestic soybean arrival in Hong Kong from September to October. Oil refineries have an obvious attitude towards price fixing. The spot price of soybean meal has risen steadily, and the price focus has further moved up. As of August 31, the average transaction price of soybean meal nationwide was 4472 yuan/ton, up 249 yuan/ton from July, or 5.9%. Downstream can only maintain continuous replenishment due to low inventory in the early stage, passively accept the high price basis, and the overlapping double section stock is approaching. Downstream picking demand is improving, supporting the feed price to maintain high operation.

In general, terminal demand is expected to continue to improve in September, supported by cooler weather and double section stocking. It is expected that the total industrial feed output in September will continue to increase month on month compared with August.