2022 China's Pet Industry Market Outlook and Investment Research Forecast Report

Pets generally refer to dogs, cats, freshwater ornamental fish, birds, reptiles, etc., which are raised at home as companion animals. The pet industry has a history of more than 100 years in developed countries, and the pet related industry has become very mature. The domestic pet industry started relatively late, but with the improvement of people's economic level, the change of ideas, the aging of the population and the growth of single and DINK groups, raising pets has become a kind of emotional sustenance for people. People get warmth and companionship from pets, and the pet economy has developed rapidly. The pet economy is also known as "other economy". Compared with the traditional pet medical care, pet supplies and other pet consumption around the "food, clothing, housing and transportation" of pets in the past, more and more consumption involving the spiritual level of pets has begun to gradually upgrade, resulting in a series of "anthropomorphic" services.

1、 Industry definition

The pet industry refers to all fields related to pets, mainly including pet food, pet medicine, pet training, pet raising, pet supplies, pet beauty, pet insurance, etc. The details are as follows:

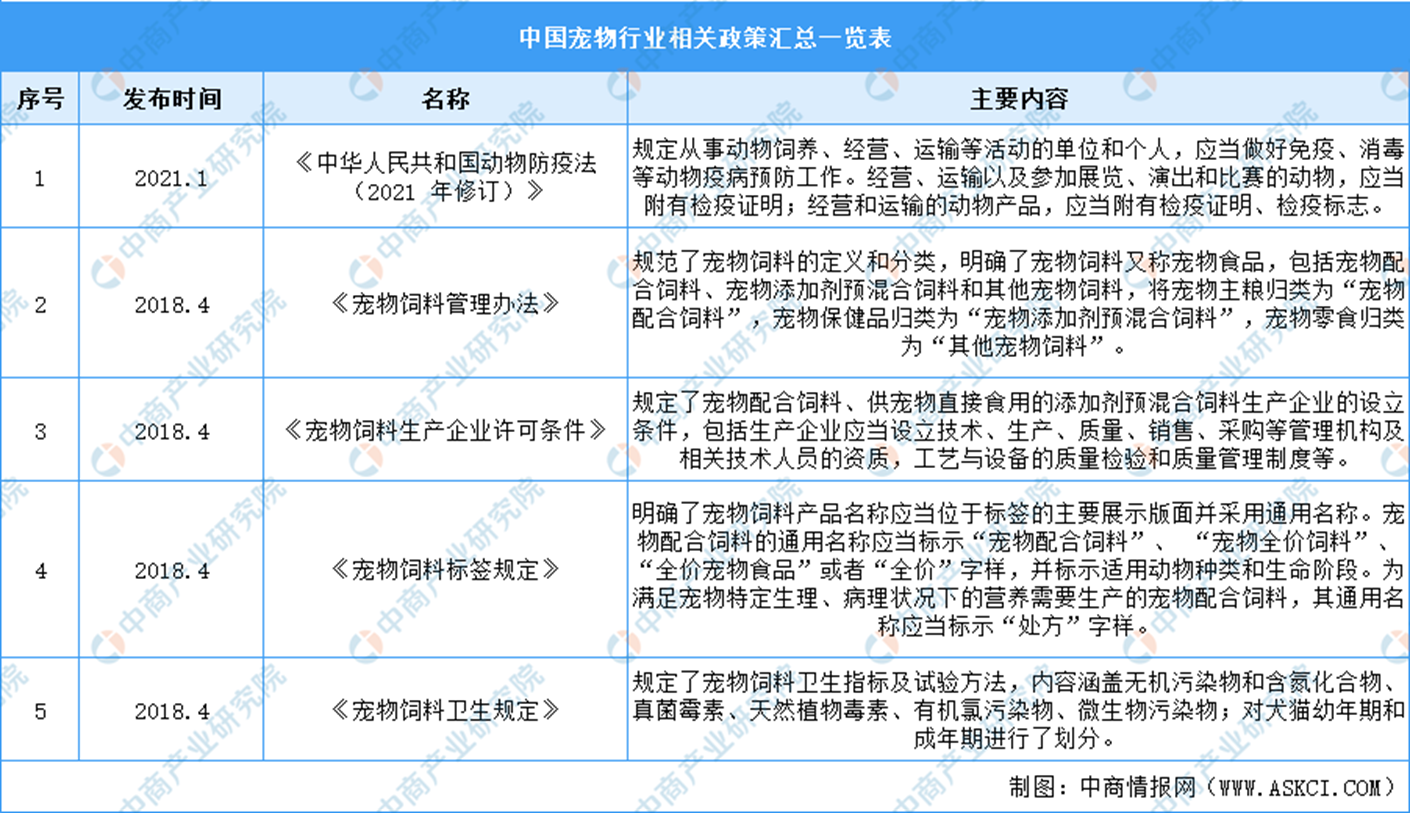

2、 Industry policy

At present, there are few laws, regulations and industrial policies in the pet and pet food industry. Relevant national departments are studying and drafting relevant regulations, and the whole industry is gradually developing towards standardization. In recent years, the main domestic laws and regulations on the supervision of major feed and feed processing industries and the relevant national standards for pet food are as follows:

3、 Industrial chain diagram

With the development of the times, pets have a wide range, including animals, plants, virtual pets, electronic pets, etc. The upstream of China's pet industry chain is pet breeding, selling and virtual pets; The middle reaches are pet products, mainly including pet food and supplies; Downstream is the service market for pets, mainly including pet medical care, pet beauty, pet training, etc.

4、 Market analysis

1. Market size

In recent years, people's spiritual needs for pet companionship have become increasingly prominent. In 2012, the scale of China's pet (dog and cat) consumption market was only 33.7 billion yuan. According to the data in the 2021 White Paper on China's Pet Industry, the scale of China's urban pet (dog and cat) consumption market will reach 249 billion yuan in 2021, an increase of 20.58% over 2020, and the growth rate has returned to the pre epidemic level. The compound growth rate from 2012 to 2021 was 24.88%. In addition to the impact of the epidemic in 2020, since 2012, the annual growth rate of market size has been maintained at more than 10%. With the continuous improvement of the penetration rate of pet families and the maturity of the industry, the market size of China's pet industry is showing a steady increase. It is estimated that the market size of China's pet industry will reach 269.3 billion yuan in 2022.

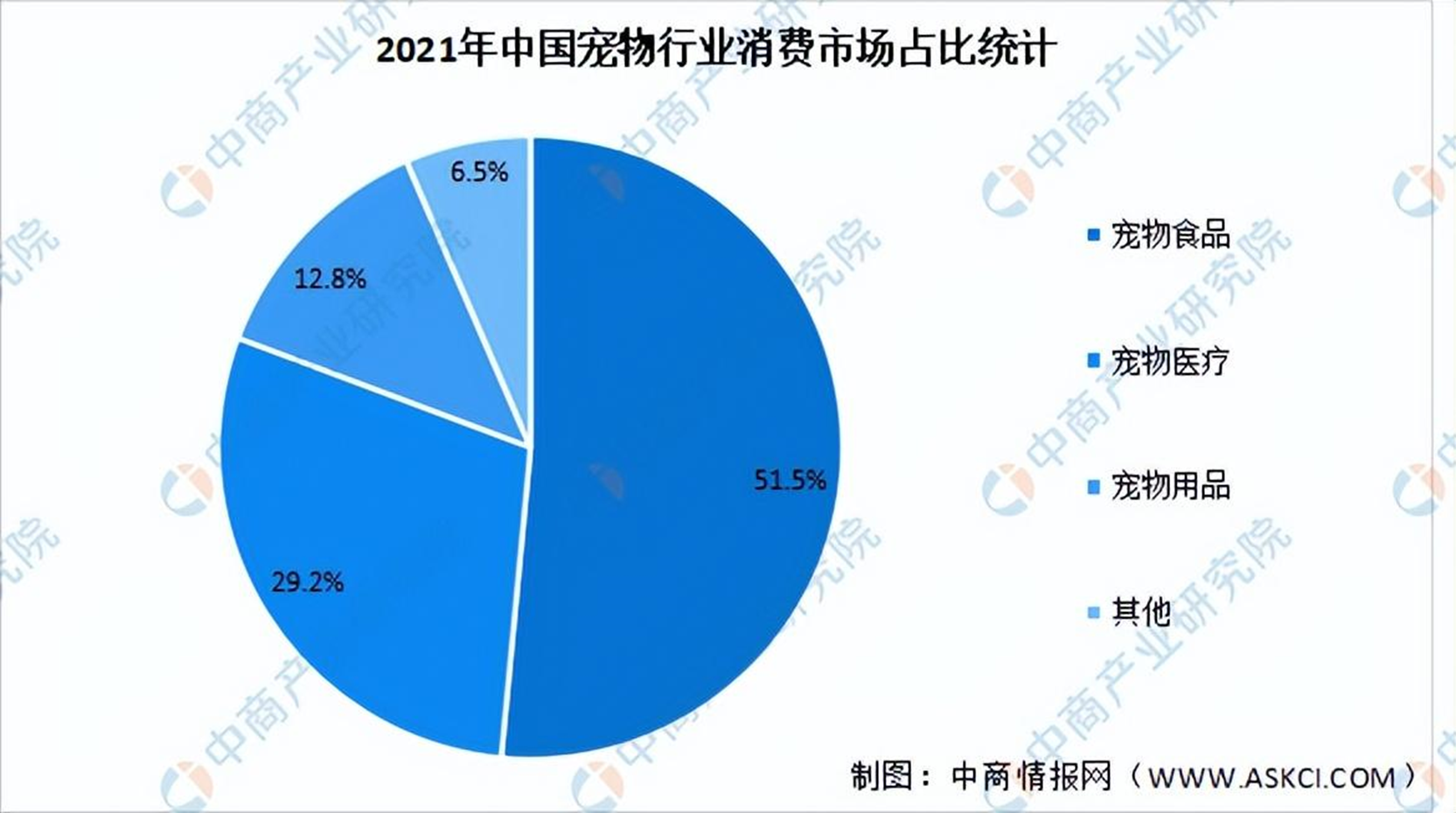

2. Market share

In China's pet industry segment, pet food is the largest segment of the pet industry, accounting for 51.50%. With the improvement of people's awareness of feeding commodity food, the market demand for pet food will be further released.

3. Segmentation

Pet food is a rigid demand for raising pets, which runs through the whole life cycle of pets. It has the characteristics of high repurchase, low price sensitivity and strong viscosity. The pet food market is the largest segment of the pet industry, and it is also the first to benefit from the development of the pet economy.

International experience shows that the economic level is closely related to the development of the pet food market. The increase of per capita income has promoted the continuous upgrading of residents' consumption, and the scale of pet food market has also increased. In addition to the impact of the epidemic in 2020, the annual growth rate of the pet food industry market has been maintained at more than 20% since 2012, with a compound annual growth rate of 26.28%, far exceeding the world average of 6.17%. The market scale of China's pet food industry will reach 128.2 billion yuan in 2021, and it is estimated that the market scale of China's pet food industry will reach 150.8 billion yuan in 2022.

4. Number of pet owners

According to the White Paper on China's Pet Industry in 2021, the number of people raising dogs and cats in China will reach 68.44 million in 2021, an increase of 8.7% over 2020. In 2021, there will be 36.19 million dogs and 32.25 million cats in cities and towns across the country. The scale of cats is smaller than that of dogs, but the growth rate will be higher. The year-on-year growth rate in 2021 will reach 19.4%.

5. Investment and financing

Enterprise investigation data shows that in 2021, the total financing amount of pet track in China will exceed 3.62 billion yuan, with 57 financing cases. From a single project perspective, Ripple Bio, which is engaged in animal health products and veterinary drugs, has received 1.336 billion yuan in total financing, ranking first. Chongxing Pet is a supplier of pet products. In 2021, it will obtain two financing with a total amount of 600 million yuan, ranking second. It is worth noting that in addition to the financing of projects providing pet food and pet services, commercial pet cloning enterprises such as Sinovale and Seaman Gene have also received considerable financing, becoming the spark of the pet track.